Last Updated on April 5, 2024 by admin

Are you thinking of going solar? But is the big solar investment holding you back? Don’t worry! To help more people shift to renewable energy and install solar there are numerous solar tax credits and rebates available to reduce the cost of going solar for home and business owners. These incentives to go solar are available at the federal, state, and often many local levels and will help repay you for some of the cost of a solar panel system installation. The federal Solar Investment Tax Credit (ITC) is one of the most important incentives for going solar.

What is a Tax Credit?

A tax credit is an incentive for lowering your yearly tax burden. It can reduce the amount of taxes you owe. Tax credits are distinct from exemptions that would lower your tax burden.

What is the federal solar tax credit?

The 30% solar ITC was implemented by the federal government in 2006. Since then, the solar business in the United States has expanded by over 10,000%, with an average annual growth rate of 50% during each of the last ten years.

The solar sector has added billions of dollars to the economy every year and created hundreds of thousands of jobs. The ITC incentive has had a powerful, positive impact on both the economy and jobs growth in the country. As such, the government has extended the popular incentives and if you install solar panels, you will receive the federal tax credit for that year.

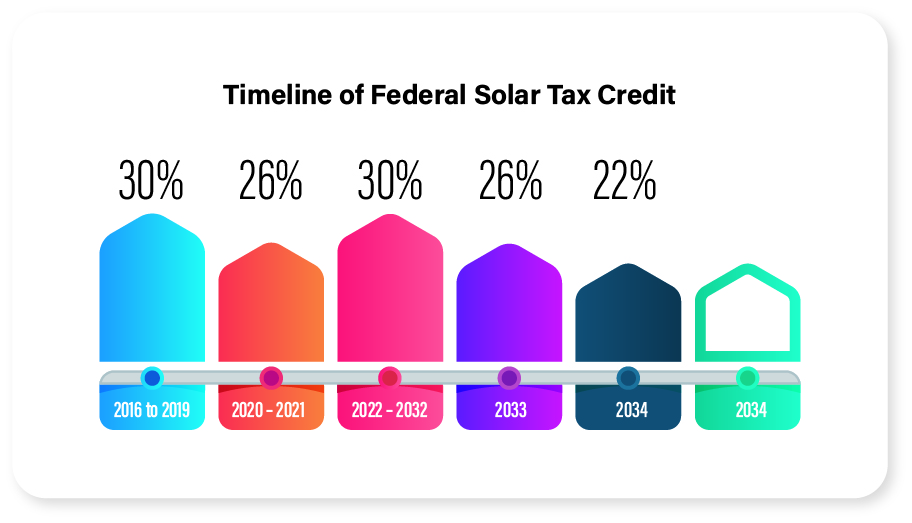

The value of the ITC for solar PV installations has changed over time. Between 2020 and 2021 it fell to 26% between 2020 and 2021. However, Congress Returned the ITC to its original 30% rate in August 2022 through and 2032. For systems deployed in 2033 and 2034, respectively, it will drop to 26% and 22%, respectively. If Congress does not extend the tax credit after that, it will expire starting in 2035.

How does the federal solar tax credit work?

You can claim the ITC when you file your federal income taxes. The claim covers 30% of the costs of a solar system when you install a solar photovoltaic (PV) system and related systems, like an energy storage system, during that tax year.

For instance, if you invested $15,000 into installing a solar array you would have a $4,500 federal tax credit. That means a $4,500 reduction in your tax bill in the next year. This is not the same as a regular tax deduction, which reduces your overall taxable income and may also lessen your tax liability.

You are only allowed to claim the full value of the credit once. However, your credit will roll over to the following year if the taxes you owe are less than the credit you received that year.

If you qualify for more federal solar tax credits than the amount of taxes you owe, the IRS allows you to save the extra credits for later. You can use them to lower your taxes in the coming years.

What does the federal solar tax credit cover?

Homeowners who install solar panels in 2024 will receive the 30% ITC on the following costs:

Solar panels

Solar equipment including inverters, wiring & solar mounting accessories

Labor costs for installing solar panels, including inspection and permit fees

Solar battery storage system costs

Sales taxes for qualified solar installation costs

What are the eligibility criteria for the federal solar tax credit?

The main criteria to meet the ITC is that your solar system is new and installed within the years that the ITC is available. Additional conditions include:

You must purchase the system. Leased systems or systems installed through a power-purchase agreement aren’t eligible.

The location must be the United States

It must be installed at your primary or secondary US residence, which can include houses, condos, mobile homes, houseboats and co-ops. If the system is part of an off-site community solar project the ITC may apply if the energy produced counts against your electric bill.

How do I claim the federal solar tax credit?

Claiming the federal tax credit doesn’t require much effort. Here’s how it works:

Complete your solar panel system installation with a qualified solar installer.

Complete IRS Form 5695, the Residential Energy Credits form and file it with your taxes for the year your solar array installed, typically the next year.

You won’t necessarily “receive” anything because the credit lowers your tax bill. However, the credit will lower your tax bill for that year when you file it with your taxes.

Does the federal solar tax credit cover battery storage systems?

The federal ITC also covers some battery storage systems as well. However, how you charge the battery is the main determinant of whether or not it qualifies for the ITC. Currently the battery system must connect to a renewable source like a solar panel to qualify for the ITC.

How do other incentives affect the federal solar tax credit?

Customers who install solar energy systems can benefit from multiple incentives that can lower the overall cost of system installation beyond the ITC. These incentives include state tax credits, renewable energy certificates, and electric utility rebates. These will not change the ITC a system is eligible for.

● State Solar Incentives

In addition to the federal ITC, many states and Puerto Rico provide solar incentives to encourage homes to install solar. While the incentives offered by each state vary, tax credits, rebates, and renewable energy certificates (which reimburse renewable energy users for producing carbon-free electricity) are all frequently used incentive programs. States like California, Texas, Minnesota, and New York provide a lot of solar subsidies.

Since state-specific solar rebates differ speak with your local solar installers to learn which you’re eligible for and refer to the Database of State Incentives for Renewables & Efficiency.

● State Tax Credits

State tax credits are similar to the federal ITC in that they apply to your state taxes. States differ in their exact amounts, and in most cases, they don’t change your federal tax credits.

● State-Level Government Incentives

A solar rebate from your state government might cut your solar costs by an additional 10% to 20%. In some state a solar power system may qualify for upfront rebates as well. Research rebates in your state to take advantage of such incentives before they expire and talk with local solar experts to what you’re eligible for.

● Solar Renewable Energy Certificate

Another type of state-level solar incentive is a Solar Renewable Energy Certificate (SREC) or Solar Renewable Energy Credit. The SRECs are based on the energy production of your solar power system, which is monitored by the utility or state. After you produce a certain amount you’re granted an SREC, which you can receive as cash or a credit for your energy bill or you can sell to other energy producers to offset their energy production using fossil fuels.

Is the federal solar tax credit refundable?

The solar tax credit can reduce your tax bill, but it cannot exceed the total amount you owe. Tax law designates it as “nonrefundable,” meaning the IRS won’t issue a check if the credit brings your overall tax liability below zero. However, you can carry forward any unused portion of the tax credit to the next year and apply it to reduce your taxes in that future year.

What projects are eligible for the federal solar tax credit?

Other types of residential renewable energy projects are also covered by the domestic clean energy credit. They are as follows:

Solar electric

Solar water heaters

Small wind energy

Biomass fuel

Fuel cells

Geothermal heat pumps

In a nutshell, by combining federal, state and local solar tax credits and financial incentives, you can cut the costs of installing a solar power system. Although the initial installation involves a substantial upfront investment, leveraging these programs significantly lowers the expense of the system. They offset a portion of the expenses associated with setting up a solar array making adopting solar energy more affordable and appealing to homeowners and businesses.

To learn more about local and federal incentives, reach to SolarSME to talk with top-rated solar installer near you.

5 thoughts on “How Does The Federal Solar Tax Credit Work?”

Pingback: How does the federal solar tax credit work? - Solar SME | Global Article Finder

Pingback: How does the federal solar tax credit work? - Solar SME | Submit a Free Article

Here you go: https://twitter.com/Solarsmeinc

Pingback: How does the federal solar tax credit work? - Solar SME | Global Article Finder

Pingback: How does the federal solar tax credit work? - Solar SME | PopulArticles

Comments are closed.