- Updated On: February 20, 2025

Federal Solar Tax Credit: How it works in 2025

Are you planning to transition to clean energy but the high upfront solar installation cost is holding you back? Don’t worry! To help people adopt renewable energy, there are multiple solar tax credits and local rebates available to offset the cost of your solar system. These incentives are available at the federal, state, and local levels. The “Federal Solar Tax Credit” is one of the most valuable federal incentives that help you to cut your PV system cost by 30%.

It may have been heard that the Trump Administration’s order stopped financing for the Inflation Reduction Act supporting programs like the federal solar tax credit. However, as of now, you should still be able to claim the incentive in 2025. Whether you are a homeowner looking to lower high bills, achieve grid independence, or a business aiming to lower operating costs, now is the best time to decide and take advantage of the best solar incentives, like the federal tax credit.

In this article, we will assist with everything you need to know about qualifying for the solar federal tax credit and how you can maximize savings by taking advantage of this incentive.

What is the federal solar investment tax credit (ITC)?

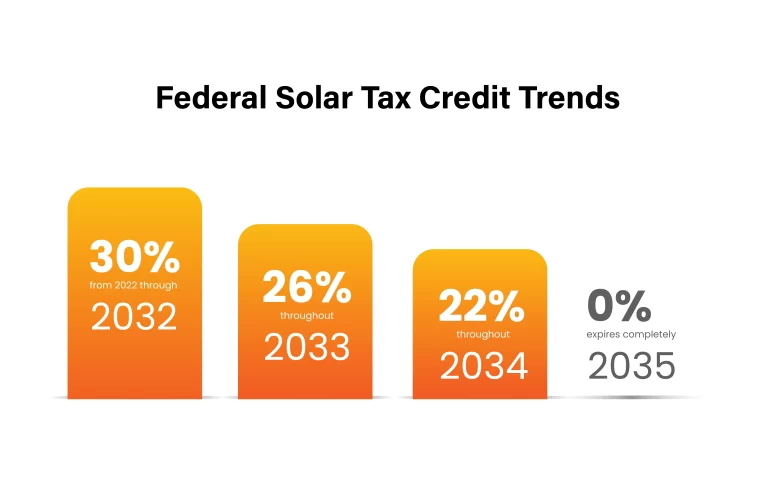

With the federal solar tax credit, also known as the investment tax credit or ITC, you may offset 30% of the cost of your solar energy system from your federal taxes. For instance, if the actual cost of your residential solar power system is $40,000, you will receive a $12,000 tax credit. However, the value of the ITC for solar PV installations has changed over time. Between 2020 and 2021, it dropped to 26%. After that, Congress returned the ITC to its original 30% rate in August 2022 through 2032. In 2033 and 2034, respectively, it may drop to 26% and 22%. Also, it will expire in 2035 if the regulations do not extend it.

$40,000 solar installation costs X 30% FTC = $12,000 tax credit value

Will Donald Trump end the solar tax credit in 2025?

A common concern of people planning to go solar is “Will Trump end federal tax credit policy?” The fear is logical but we can expect that at least this will not happen in 2025. Congress has the authority to control the availability of tax credits. To pass a new law, it is vital to alter the current tax credit policy. However, lawmakers are not convinced to make a new law and stop this incentive that supports people to embrace clean power.

How does the federal solar tax credit work?

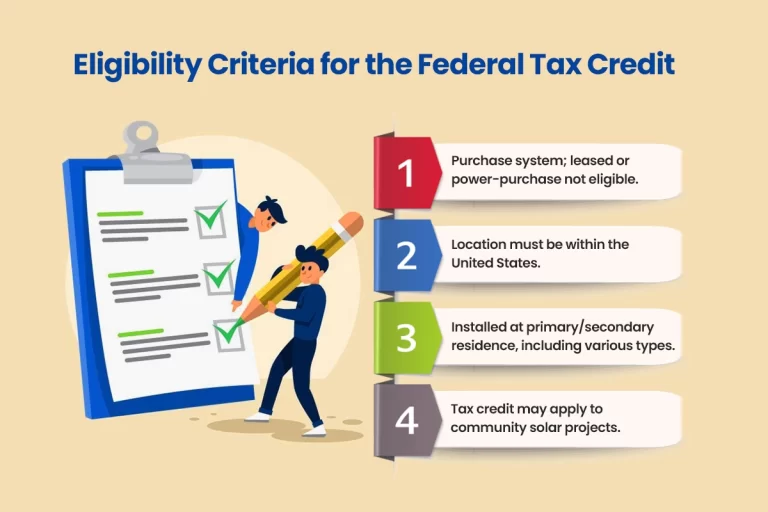

The investment tax credit is a popular incentive, and what distinguishes it from other solar rebates is that it lowers your tax liability. Also, all income groups including low-income homeowners are eligible for the program because there is no income cap. If you own a solar energy system installed at your primary or secondary residence (house, condo, mobile home, houseboat, or co-op), you may qualify for the solar investment tax credit. Community solar systems may also qualify if the generated electricity is credited to your home.

But if you do not own the system or you have a lease or power purchase agreement (PPA) with a solar installation, you cannot benefit from a 30% credit.

If you want to use your tax credit this year, make sure you are getting a tax bill because you have to owe taxes to be eligible for one. You can roll over the surplus credit amount annually until the ITC expires in 2034 if your tax bill isn’t big enough to claim the whole credit in a year.

When do I claim the solar tax credit after solar installation?

You must submit an ITC application during the year your system is installed and your utility grid permits you to operate (PTO). You should confirm that the PV installation year must align with the year it is turned on, as it often takes 2 to 3 weeks or more to receive PTO from your utility.

For instance, if you bought solar panels in December 2025 but your utility didn’t give you paid time off until 2026, you would have to wait until your 2026 tax return to collect the tax credit.

What does the federal solar tax credit cover?

Homeowners who install solar panels in 2025 will receive the 30% ITC on the following costs:

How do I claim the federal solar tax credit?

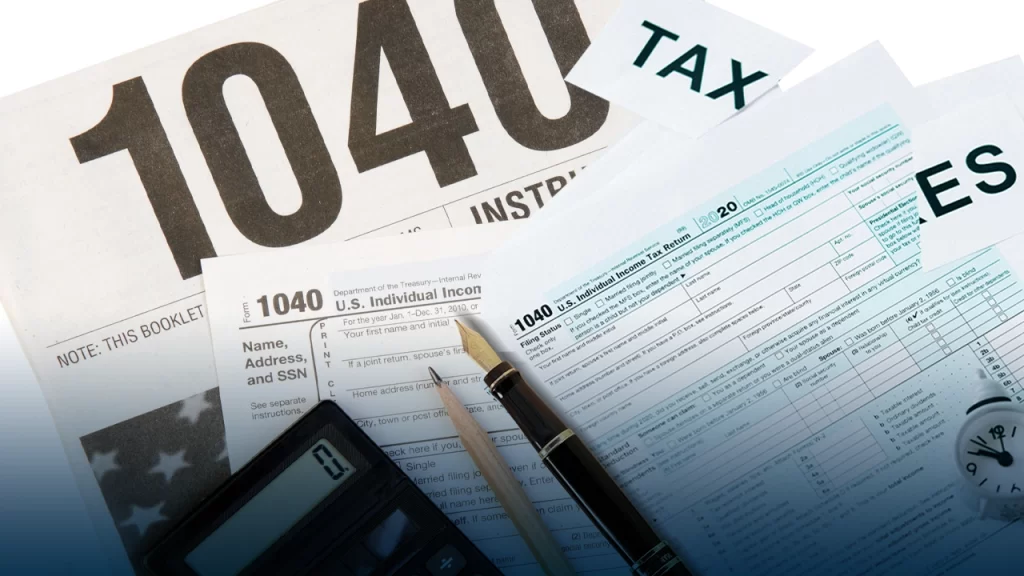

It’s simple to claim the tax credit! When you file your annual taxes, just complete the related forms. Here are the key points to know about claiming the federal tax credit:

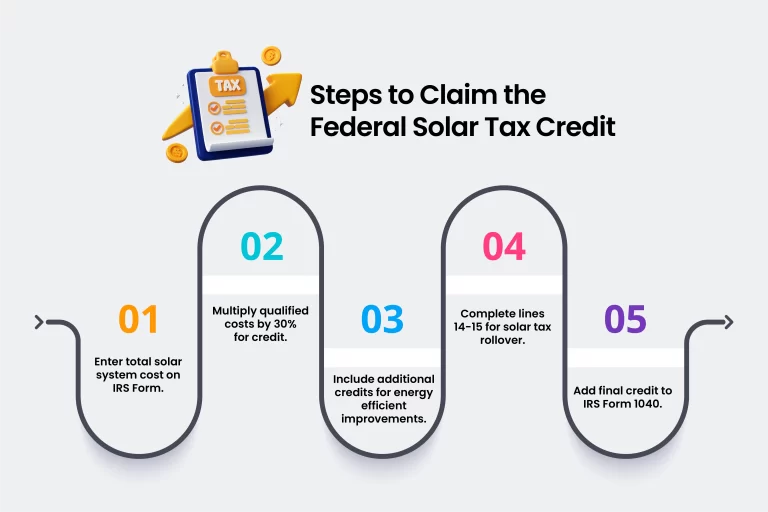

- Enter the total cost of the solar system on line 1 of IRS Form 5696, which is titled “qualified solar electric property costs.” List the total expenses on the appropriate lines if you install energy storage or other eligible equipment.

- Multiply the total qualified costs by 30% to determine the overall credit value.

- Include any additional credits you have accrued, such as the credit for energy-efficient home improvements.

- To decide whether you have any solar tax credit rollover for the following year’s return, complete lines 14 and 15 on IRS form 5696.

- To determine your ultimate tax liability, add the final tax credit value to IRS Form 1040.

How to use the federal tax credit in combination with other incentives?

Depending on where you live, you can benefit from several statewide solar incentives in addition to the federal solar residential tax credit:

Net Metering:

A billing method known as “solar net metering” enables you to get credits on your utility bill for any excess electricity that your solar energy system produces and sends back to the local grid.

State Local Rebates:

Receiving a state solar rebate has no impact on your eligibility to get the ITC. However, while claiming local rebates, make sure to speak with a qualified tax expert, as it may have an impact on your taxable income.

State tax credit:

In addition to the ITC, several states provide their local solar incentives, though laws may differ.

Income from SRECs:

SRECs offer you to get paid for the electricity your solar panels produce. For every 1 MWh of electricity, you earn 1 solar renewable energy credit.

Utility Rebates:

If your utility is offering any rebate in your area, it may be subtracted from the total system cost before tax credit. So, it may reduce your FTC value but you can still take benefit of additional incentives. For instance, if your PV system costs $25000 and the utility rebate value is $10000, the FTC will be applicable on $15000 instead of $25000

30% x (Total system cost – Utility rebate amount) = Federal tax credit value

With a 30% federal tax credit and the best solar incentives, there is no better time to transition to solar than now. Why? These incentives will not last, may change over time, or expire. For example, net metering policies are facing challenges nowadays, and solar rebates are expiring. We advise you to plan your solar installation to take full advantage of these benefits and minimize your upfront cost.

SolarSME is a local solar installer, offering affordable solar and backup solutions tailored to your energy needs. Book an Appointment to learn how to take advantage of FTC and local solar incentives in your state. Get a FREE Estimate of your solar savings

Related Articles:

Community solar is revolutionizing the shift to solar power. These programs allow people to utilize clean power from solar farms without any upfront cost or solar installation expenses. Explore which states are offering these programs.

Solar power is becoming an increasingly popular choice for homeowners and businesses in Texas.

Every year, more people choose solar panels for their homes and businesses. Compared to the first quarter of 2022, the number of residential solar systems installed increased by 30% in 2023.