Unlock the Power of

Solar in Texas

Illuminating Texas Homes and Enriching

Lives with Solar Energy in Texas

Our Locations:

United States.

Call Us!

(214) 227-9736

Advantages of Installing

Solar Panels in Texas

Abundant Sunshine

With heaps of long sunny days throughout the year, Texas offers an ideal environment for solar power generation. This abundant sunlight ensures that solar panels in Texas will consistently produce energy, making it a reliable source of energy for both homes and businesses.

Reduced Energy Bills

By investing in solar energy, homeowners and businesses can significantly reduce their dependence on grid power from the beleaguered ERCOT system and the maze of utilities in the state. This leads to lower energy bills and protects against rising electric costs in the future.

Energy Independence

Solar power allows homeowners and businesses to generate their electricity, giving them more energy independence. This is especially valuable during times of grid outages or emergencies when having a reliable power source like solar and a backup solution is a must-have.

Environmental Sustainability

Solar power is a clean and continual energy source, you don’t need to add oil, gas, or coal to keep it operating. And there’s no smoke or carbon emissions you have to deal with. Choosing solar energy also contributes to a more sustainable future.

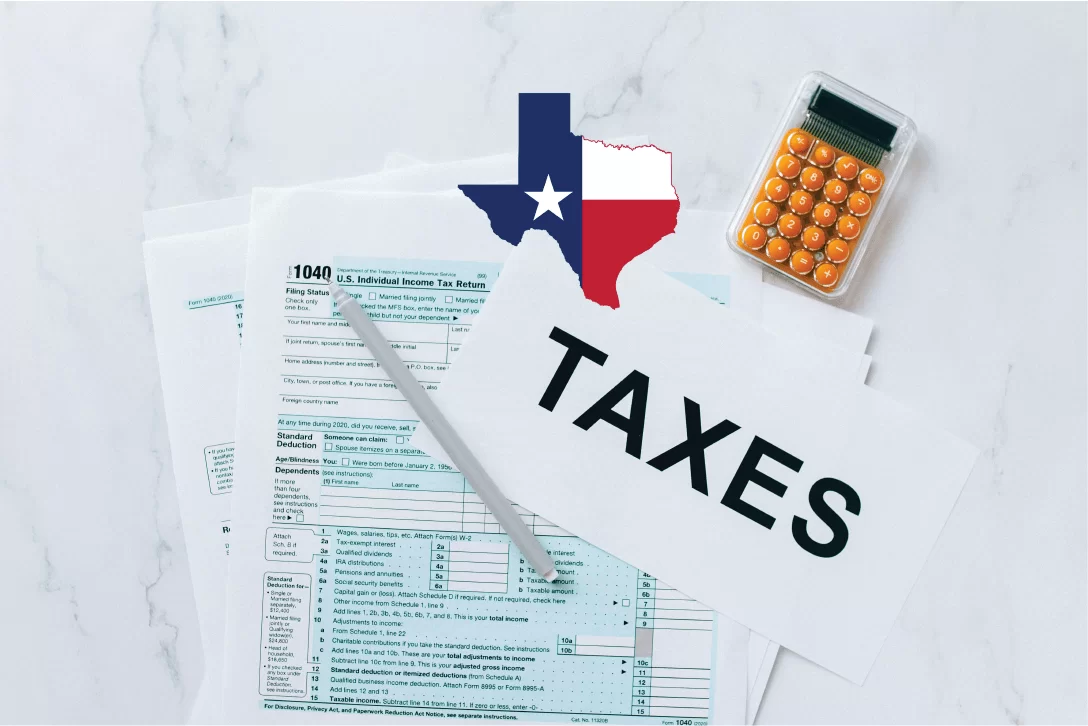

Solar Incentives for Homeowners in Texas

To encourage the adoption of solar power, Texas and utilities offer incentives and rebates for homeowners looking to install solar panels on their properties. Look for the best solar panel installation companies to help you determine your energy needs.

Solar Property Tax Exemption

Texas provides a property tax exemption for the added value of solar or wind-powered energy devices. This means that the increased value of your property due to the installation of solar panels won’t be considered in property tax assessments.

Solar and Wind Sales Tax Exemption

Another incentive to help solar owners in transition to solar is sales tax exemption. The state exempts the purchase of solar panels and related equipment from state sales tax, making the initial investment in solar technology more affordable for homeowners.

Net Metering

Texas has favorable net metering policies, allowing homeowners to receive credits for excess energy produced by their solar panels. These credits offset electric use from the grid during less solar-producing periods, like cloudy days and at night.

Federal Solar Tax Credit

The government has extended the popular Investment Tax Credit (ITC). If you install solar panels, you will receive a 30% federal tax credit for that year. The value of the ITC for solar PV installations has changed over time and will go down in the future.

Business Incentives for Solar Energy in Texas

making solar power an attractive investment for businesses.

Solar ITC

MACRS

Property Tax Exemption

Similar to homeowners, businesses in Texas can take advantage of the property tax exemption for the added value of solar energy devices. This exemption helps reduce the overall cost of solar installations for commercial properties.

Performance-Based Incentives

Solar Rebates in Texas: Maximizing your Solar Savings

These programs provide direct cashback or discounts on your solar installation costs, making the installation of

Solar Panels in Texas even more financially appealing.

Texas Solar Panel Rebate Program

Texas Solar Water Heating Rebate Program

Solar Buyback Plans in Texas

Several Texas utility companies offer solar buyback plans, where they purchase excess electricity generated by your solar panels at a predetermined rate. This not only helps you recover your investment more quickly but also allows you to contribute to the grid’s stability. Companies like Austin Energy, Entergy, CoServ Energy have popular buyback programs that reward customers for their solar contributions.

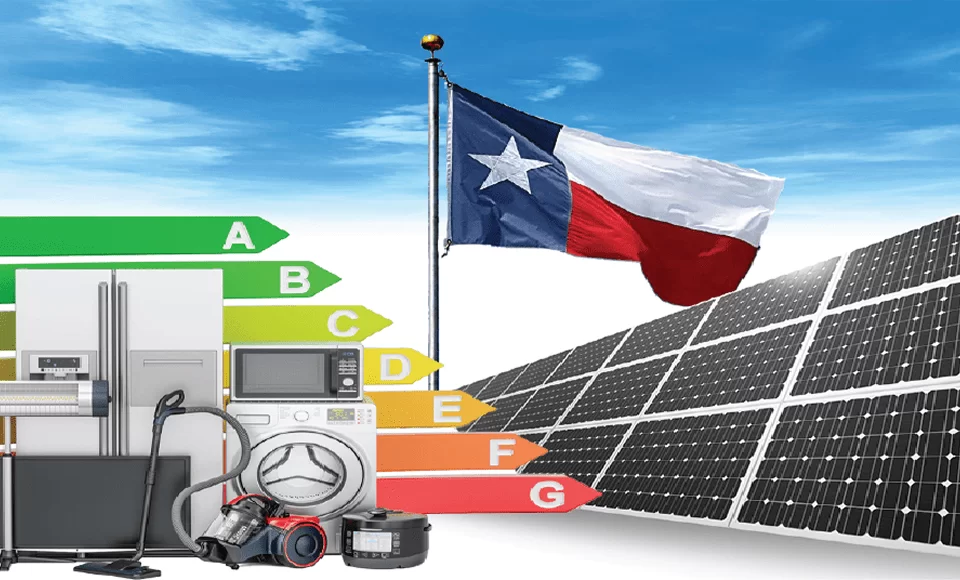

Texas Energy-Efficient Appliance Rebate Program

Texas Energy-Efficient Appliance Rebate Program

Research Available

Rebates

Stay informed about the latest rebate programs in Texas from DSIRE. Government and utility-sponsored rebates do change, so regularly check for updates and deadlines to ensure you don’t miss out on potential savings.

Work with Certified

Installers

Choose a solar installation company with experience and certification. Many rebate programs require the use of certified installers to ensure the systems meet quality and performance standards.

Combine Incentives and Rebates

Maximize your savings by combining state incentives with rebates. This strategic approach should significantly reduce the overall cost of your solar installation and any other energy-efficient purchases you make.

Consider Financing

Options

Explore solar financing options to cover upfront costs and allow you to benefit from rebates immediately. Solar loans or leasing programs may offer flexible terms that align with your budget.

Monitor Energy

Consumption

Optimize your solar investment by monitoring and managing your energy consumption. Understanding your energy needs enables you to size your solar system appropriately, maximizing both savings and rebates

Got any Questions?

Solar SME Installation Services in Texas

Explore your Solar Savings in Texas!

Frequently Asked Questions

In Texas, installing solar panels is totally worth it. In comparison to other states, various factors affect how quickly you break even on your investment, including the cost of power, incentives, climate, and the angle at which the sun hits your roof.

In Texas, businesses that offer “free” solar panels don’t necessarily mean that you will receive them for nothing. Rather, they usually provide options such as solar leasing or Power Purchase Agreements (PPAs). Although there are no initial expenses associated with them, they do have long-term costs. A certified solar installer in Texas like Solar SME can assist you with best solar incentives in TX for cost saving.

On average, Homes with solar panels sell more quickly than those without. Energy-efficient and environment friendly homes are attracting too many buyers.

Solar SME is one of the best local solar companies in Texas offering affordable residential and commercial solar solutions with flexible financing options. If you are looking for solar power installers near me, SolarSME is here to make your solar journey convenient.

It is possible to sell solar energy back to the Texas electricity system. With solar buyback plans or net metering, the majority of electricity suppliers will pay you for any unused solar energy. If you are planning residential solar panel installation, your solar installer can guide you about utilities plans.