Unveil Benefits of Solar

Systems in Virginia

Lighting up the Path to Solar-Powered Living for

Homes & Businesses!

Solar Energy in Virginia Continues to Grow

Virginia Solar Incentives for Homeowners

Residential Property Tax Exemption for Solar

Solar panels increase the value of your house, just like any other home improvement project. There is a property tax exemption in Virginia to keep this increase in home value from raising your home taxes. For instance, if you install a $20,000 solar power system on a $350,000 home, your home value is taxed at $350,000. That’s rather than the $370,000 it’s worth after installing solar. If the property tax rate where you live is 0.75%, you’re not charged for the additional $150 on property taxes. Without the tax break, you would.

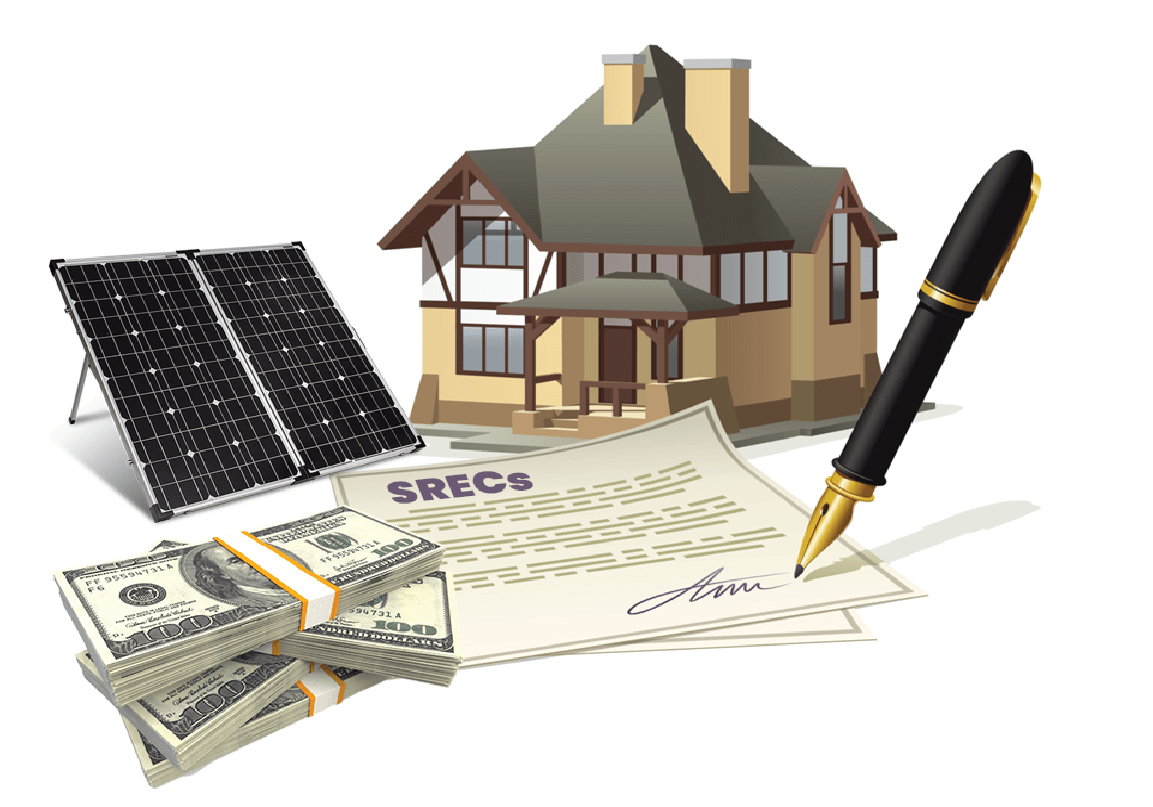

Virginia Solar Renewable Energy Credits (SREC)

Virginia is one of the states where solar is incentivized with Solar Renewable Energy Credits (SRECs). You receive 1 SREC for every 1,000 kilowatt-hours that your solar panels produce. You can sell the SRECs to nearby utility companies and other businesses that must comply with renewable energy regulations regarding their greenhouse gas emissions. That’s in addition to the ongoing savings on electric bills and net metering benefits, helping you recoup your solar installation investment faster.

Virginia Net Metering

For residential solar systems with up to 25 kW of capacity, Virginia provides net metering. Your power bill is credited with any excess solar generation your system sends to the electric grid. If your excess generation exceeds your monthly consumption, it is credited to your electric bill in the next month and deducted from your next payment. In Virginia, Dominion Energy has the biggest net metering program. On the Dominion Energy website, you can apply to net meter if you’re thinking about installing solar on your house.

Federal Solar Tax Credit

One of the most compelling incentives to install solar panels is the Investment Tax Credit (ITC). This ongoing federal incentive. Home and business owners receive a tax credit for 30% of the total cost of their solar panel installation. It is also known as the Residential Clean Energy Credit. The homeowner can claim these savings in the tax year that follows the solar installation. However, if they can’t take advantage of the full credit the first year, the ITC applies to future tax bills until the full value is credited.

Solar Incentives for Businesses in Virginia

01- Virginia SAVES Green Community Program

02- Virginia Clean Economy Act

03- Commercial Property Assessed Clean Energy (C-PACE) Financing

Solar SME Installation Services in Virginia

Virginia is taking major steps for a more sustainable future by supporting solar energy and providing incentives to both its residents and commercial sectors. Homeowners and businesses have many opportunities to invest in solar power and enjoy the advantages of clean, renewable energy at lower costs. If you are a homeowner or a business looking for an affordable solar installation in Virginia, Solar SME can help you.

Explore your Solar Savings in Virginia!

Frequently Asked Questions

Yes! Solar panel installations in Virginia are growing quickly throughout the state, and the state is currently ranked ninth in the nation.

Overall, the best orientation for solar panels is south. In almost all cases, directing your panels south rather than any other direction will result in the most electricity bill savings and the quickest payback period.

Net metering is available in Virginia from Dominion Energy. Likewise, you may send power from your own solar system back to the grid, while they do provide solar power in other states.

You must register your system and register with a broker in order to sell your SRECs. Selling SRECs in the Virginia market does not need you to be a customer of Appalachian Power or Dominion Energy.

Solar SME is one of the best solar providers in Virginia. We specialize in providing reliable solar solutions tailored to your needs. Whether you’re interested in reducing energy costs or enhancing your home’s sustainability, our expert team ensure a seamless and efficient installation process.