Our Location:

Call Us!

(480) 573-8988

Arizona, known for its vast deserts, breathtaking landscapes, and abundant sunshine, has emerged as a leader in solar energy use. With its vast stretches of open land and an average of 6.5 peak sun hours a day, Arizona is an ideal place to harness the power of the sun. Smartly, over the last decade homeowners, businesses and utilities across the state have turned to solar power as a clean and renewable energy source. In fact, some of the largest solar installations in the world are in Arizona. In this guide, we will explore the benefits of going solar in Arizona, as well as the many incentives and rebates available to help individuals and businesses in the state tap into this rich resource to save them money.

Why Go Solar in Arizona?

Arizona has over 300 days of sunshine per year on average, making it one of the sunniest states in the U.S. This makes Arizona an ideal location for harnessing solar energy to power homes and businesses. By going solar, Arizonans can reduce their reliance on fossil fuels, lower their energy bills, and contribute to a cleaner, more sustainable future.

Solar Incentives and Rebates for Homeowners in Arizona

Arizona residents are eligible for a 30% federal solar tax credit, a property tax exemption, and a sales tax exemption on solar equipment in addition to the federal solar tax credit.

Arizona State Residential Solar Income Tax Credit

The Grand Canyon State provides a solar tax credit equal to 25% of your solar installation expenses, capped at a maximum of $1,000. Homeowners can request this personal income tax credit during their state tax filing. It’s important to note that individuals who lease solar systems or participate in power purchase agreements (PPAs) are not eligible for this credit.

Incentive Amount:

Maximum of $1,000

Frequency:

One-time tax credit

Energy Equipment Property Tax Exemption

When you install a solar power system, it can increase your home value. However, in Arizona, there’s a property tax exemption to spare you from paying taxes on this added property value. Importantly, this exemption isn’t limited to just solar panels—it also covers energy-efficient upgrades like passive solar technology (such as a Trombe wall), solar pool heaters, solar space heaters, solar thermal electric systems, and solar water heaters.

Incentive Amount:

Full exemption on Property Taxes for the increased value of a solar panel system

Availability:

Ongoing exemption, starting from the date of installation

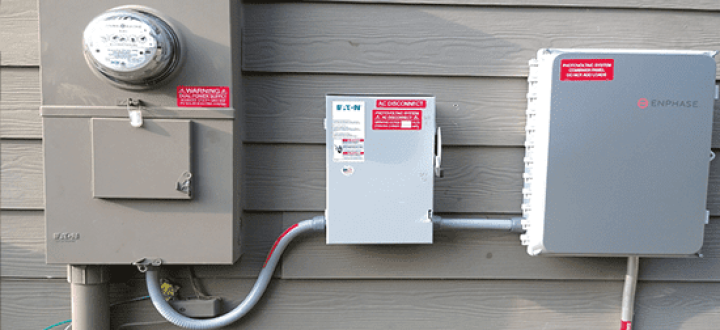

Solar Equipment Sales Tax Exemption

The Arizona Department of Revenue offers a sales tax exemption for solar energy equipment and its installation, but this applies only when approved contractors carry out the work. It’s essential to note that this exemption doesn’t cover items like solar battery storage or other accessories that aren’t integral to the solar power system.

To benefit from this exemption, your solar installer in Arizona must register with the Arizona Department of Revenue (using Arizona Form 6015). As the customer, you typically won’t need to take any specific action in this process; it’s primarily the responsibility of the installer to ensure the exemption is applied correctly.

Incentive Amount:

Complete waiver of sales tax on qualifying solar equipment

Frequency:

One-time exemption from sales tax

Arizona Net Billing

Most rooftop solar installations are eligible for the net billing program in Arizona offered by utility companies. Similar to net metering, net billing enables homeowners to receive credits for excess energy produced by their solar power systems on their electricity bills. Customers are credited for their excess energy generation at a non-retail rate, in contrast to net metering. Usually, this is much less valuable than net metering at a full retail rate. Currently, the rates for extra energy produced by your solar panels range from $0.0781 to 0.1045 cents per kilowatt-hour (kWh).

Federal Solar Tax Credit in Arizona

Homeowners and businesses in Arizona are eligible for the federal solar investment tax credit, or ITC. This allows you to deduct from your federal taxes an amount equal to thirty percent of the cost of installing solar panels. You are qualified for this credit if you own your solar panel system and are a homeowner, condominium owner, or member of a cooperative housing corporation. Currently, the ITC is 30%. This credit will drop to 26% in 2033 and 22% in 2034 before it expires in 2035 under the terms of the Inflation Reduction Act. Using IRS Form 5695, you can claim your credit on your federal tax return.

Arizona Commercial Solar incentives and Rebates

In addition to incentives for homeowners, Arizona also offers incentives and rebates for businesses looking to invest in solar energy:

Commercial ITC

Businesses in Arizona can take advantage of the ITC as well, allowing them to deduct 30% of the cost of installing a solar energy system from their federal taxes, just as homeowners can. This credit applies to both solar photovoltaic (PV) systems and solar thermal systems.

Modified Accelerated Cost Recovery System (MACRS)

The MACRS allows businesses to recover the cost of solar energy equipment through depreciation deductions. This accelerated depreciation schedule can provide significant tax savings for businesses investing in solar energy.

Commercial Solar

Energy Credit

Similar to the residential solar energy credit, Arizona offers a state tax credit for solar energy systems installed on commercial properties. The credit is equal to 10% of the cost of the solar energy system, up to $25,000 per installation.

Solar Grants and

Incentive Programs

Some utility companies and organizations in Arizona offer grants and incentive programs specifically for businesses investing in solar energy. These programs may provide financial assistance or technical support to help businesses offset the cost of solar installations.

Solar SME Installation Services in Arizona

As a leading solar contractor in Arizona, Solar SME is committed to providing high-quality solar solutions to meet the unique needs of homeowners and businesses alongside solar incentives in Arizona.

Explore your Solar Savings in Arizona!

Frequently Asked Questions

Residents can get up to $1,000 in credit, or 25% of the cost of their solar system. This is a great method to invest in renewable energy and lower your state taxes because you have to have a state tax liability to qualify. To be eligible for this credit, you must fill out Arizona Tax Form 310.

One of the greatest locations in the US for solar panel installation is Arizona because of its abundant sunshine. Arizona residents have an exceptional chance to take advantage of free, renewable solar energy and significantly reduce their electricity costs because to the state's more than 300 sunny days annually.

Under net billing, excess solar generated by a solar panel system is credited at an excess generation credit rate, which is lower than the retail rate of electricity. Depending on the utility, excess solar energy will be purchased at a rate between 5% and 30% lower than the retail rate of electricity.

The initial cost of installing solar panels can be a major consideration for many homeowners. But with excellent incentives like the 30% federal tax credit and long-term energy bill reductions, solar actually pays for itself for many Arizona homeowners!

The top solar company in Arizona depends on individual preferences and needs, but SolarSME is a standout option. Known for premium service, expert installations, and partnerships with leading solar brands, SolarSME offers competitive pricing and helps maximize solar incentives. Contact SolarSME today for tailored solar solutions in Arizona!