Solar SME Virginia

Top-Rated Solar & Battery Installers

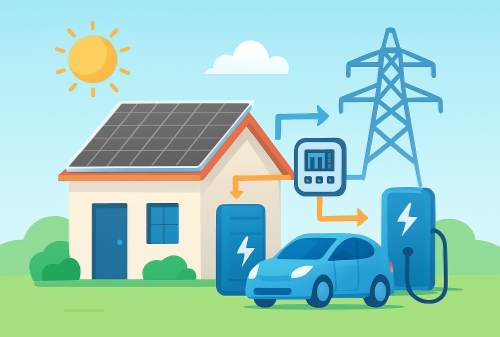

Experience energy independence with smart and sustainable power

With an average of 205 sunny days, Virginia is one of the best states for solar panel installation in the Mid-Atlantic region. The state already has more than 4.8 gigawatts of solar installed across the state. It also has over half a million homes with solar rooftops. To help Virginians prepare for a more sustainable future, the Commonwealth of Virginia offers solar incentives. These solar rebates in Virginia encourage homeowners and businesses to embrace renewable energy with low upfront costs. Solar SME is a certified solar company in Virginia serving 11 states across the United States. We offer tailored solar and backup power solutions as per your unique energy needs. Backed up by leading solar warranties, our post-solar installation services make us stand out in the market.

How much can you save on electric bills with solar in Virginia?

Virginia residents spend approximately $207 per month on electricity. This adds up to $2,484 per year. Over the next 25 years, you may expect to pay $88,000 in energy costs in Virginia. If you install a solar system, you will typically break even in 10.83 years in Virginia. The average Virginia homeowner needs a 13.49 kW solar panel system to meet their electricity requirements. In addition, you can reduce the cost of solar panels in Virginia with solar incentives like the federal tax credit and other state-specific incentives, you can save thousands of dollars on solar panels, making them a worthwhile investment. However, the amount you can save with solar panels in Virginia depends on your system selections. Also, adding solar battery storage will save you more, as you can send excess power to the grid and earn energy credits. Furthermore, with the Virginia SRECs program, you can sell your credits to the utilities and earn from them.

10 Years

84%

Solar Financing Options in Virginia by Solar SME

solar panel installation in Virginia is a smart investment for your home or business nowadays. Although losing a 30% solar panel tax credit in Virginia will increase the upfront cost, rising electricity rates, inflation, and climate-driven grid instability still reflect the value of solar. There are 3 main financing options for managing initial solar expenses.

Best Residential Solar Incentives and Rebates in Virginia

Virginia solar panel programs and local rebates support to offset the initial expenses. However, the federal solar tax credit will expire in 2025. Let’s have a look at the top solar panels Virginia incentives:

01- Residential Clean Energy Tax Credit

The Residential Clean Energy Credit, or federal investment tax credit (ITC), can reduce the cost of residential solar panels in Virginia by 30%. This incentive covers the complete system, including equipment, labour, permits, and sales tax. However, on July 4, 2025, President Trump signed legislation that totally eliminated the residential solar tax credit, effective January 1, 2026, nearly a decade before its original expiration date.

02- Virginia Solar Renewable Energy Credits (SRECs)

The Virginia Clean Economy Act (VCEA) established a renewable portfolio standard, requiring utilities to generate a specific quantity of renewable energy. Under this program, you can earn one SREC for every megawatt-hour (MWh) of clean power your panels generate, which can subsequently be sold to utilities to contribute to their renewable generation. VA SREC prices fluctuate depending on market demand, but you can expect to earn approximately $22.50 per SREC in VA. To begin selling SRECs, register your system with your utility company. Following that, an aggregator or broker will handle the acquisition and sale of your SRECs with the utility.

03- Virginia Solar Energy Equipment Property Tax Exemption

04- Battery Storage Incentives in Virginia

Is net metering available in Virginia?

If you connect your solar panel system to the grid, you can take advantage of net metering, one of the best solar panel incentives available in Virginia. Net metering policies in Virginia are generally favourable to customers. Dominion Energy and Appalachian Power Company provide net metering at the full retail rate of electricity, in a one-on-one transaction. To qualify, your solar panel system’s capacity must be under 25kW. Furthermore, it is provided on a first-come, first-served basis. Once the aggregate capacity limit for the year is reached, no new participants can enrol in net metering. Currently, the aggregate capacity restriction is 6% of the previous year’s peak-load prediction, with 1% set aside for low-income utility users and 5% available to everyone else.

Commercial Solar Installation in Virginia

Commercial solar installation in Virginia is an effective way for businesses to combat all of the power challenges. Businesses can generate power using free and unlimited sunlight via commercial solar panels. Furthermore, using solar electricity combined with a reliable battery backup system like Tesla Powerwall 3 eliminates power disruptions. Hence, enabling smooth workflow and increased operational resiliency. Like residential solar installation, you are also eligible for a 30% federal tax credit for commercial solar systems. Additionally, High Performance Building Program, MACRS Depreciation, and PACE Financing options are available for business solar installation.

Why is it worth it to switch to solar in Virginia?

Going solar in Virginia is a worthy investment that provides a massive ROI and appealing benefits. However, you need to determine your solar viability. Remember to consider include your monthly energy bills, your system size requirements and installation fee, the direction your roof faces.

Low Electric

Bills

Maximum Grid Independence

Flexible Financing Options

Increased Home Value

Earn Energy Credits/SREC Programs

Calculate your Solar Savings with Solar SME Smart Solar Calculator NOW!

Step 1:

Property Type

Step 2:

Financing Options

Step 3:

Enter Your Current Electric

Bill & System Preferences

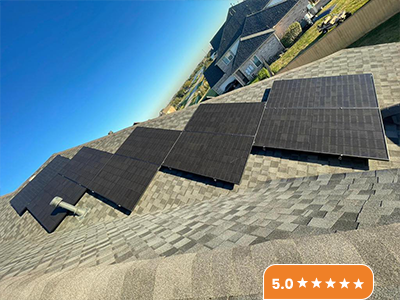

Our Customers are Getting Up to 90% Lower Electric Bills with

Solar SME Tailored

Solar Solutions

Solar SME is among best solar installers in Virginia. We provide our valuable clients with an exceptional solar experience from consultation till throughout their solar journey. We are BBB accredited and also hold a positive image in solar marketplaces like Energysage. Our customers highly recommend Solar SME for the best solar services in Virginia.

City: Richmond

System Size: 8.5 kW

Annual Savings: $1,250

City: Virginia Beach

System Size: 9.7 kW

Annual Savings: $1,430

City: Norfolk

System Size: 12.3 kW

Annual Savings: $1,820

City: Roanoke

switch to solar in Virginia

System Size: 7.6 kW

Annual Savings: $1,120

City: Alexandria

System Size: 10.8 kW

Annual Savings: $1,600

City: Chesapeake

System Size: 11.5 kW

Annual Savings: $1,730

Frequently Asked Questions

Virginia offers the Federal Solar Tax Credit (30%), net metering benefits, local utility rebates, and property tax exemptions, making solar installation more affordable and financially attractive. Moreover, VA SRECs program also helps to maximize savings.

Yes. Some utilities like Dominion Energy or Appalachian Power provide incentives for installing solar. These rebates vary by provider and can reduce upfront installation costs.

Select licensed, experienced solar installers like Solar SME who are familiar with local regulations, permitting, and incentives. They ensure proper installation, optimal performance, and smooth utility coordination.

The cost of solar system varies depending on your energy preferences. However, flexible financing options include cash purchases, solar loans, and solar leases helps homeowners spread costs while benefiting from energy savings.

With Solar SME smart solar calculator, enter property type, energy usage, and system preferences. You’ll receive an instant, personalized estimate showing potential savings and system recommendations.