- Published On:

Solar Incentives and Rebates: A Smart Way to Lower Your Solar Installation Costs

In recent years, investing in solar energy has become a smart investment not only for homeowners but also for businesses. With the rise in inflation and frequent power outages, solar with battery backup solutions are becoming popular for reducing energy costs by up to 95% and less grid dependence. Also, as solar technology advances, the prices of solar panels and other accessories are dropping. But, for many people, it is still challenging to manage the significant initial expenses of installing solar panels at their properties. The good news is that the U.S. government and some local utilities offer the best solar incentives and rebates to cut high upfront costs and encourage more people to switch to clean power.

These incentives include tax credits, property tax abatements, one-time rebates, or performance-based rebates. With the rising solar tariffs in the U.S., these solar rebates and incentives play an important role in offsetting initial expenses and making solar affordable for the community.

Understanding Solar Incentives and Rebate Programs

The purpose of solar incentive programs is to support the homeowners by lowering the high upfront cost of installing solar panel systems. But the local rebate programs vary by state. Also, they may have specific qualification criteria or capacity. Moreover, many state solar incentives may be first-come-first-serve based. So, it is important to check out the available rebate programs in your area before switching to solar. Your local solar installer, equipment manufacturer, or utility company can assist you with available solar grants in your state. Following are some basic terms to differentiate between various solar incentive programs:

How do solar rebates and incentives work to lower solar installation costs?

Solar incentives helps to offset the financial burden of installing a solar energy system either in the form of upfront discounts or incentives after installations. However, these local solar grants may expire or change over time. Also, some rebate programs may require adding a battery to your solar energy system.

Usually, your installer will apply for these rebates on your behalf or help you with the process. In some states, solar rebates can provide over $5,000. Like the Maryland Solar Access Program, it offers grants at a rate of $750/kW, depending on the size of the solar system. Applying for local rebates usually involves submitting detailed information about your solar equipment, system design, performance expectations, project costs, and/or installation company.

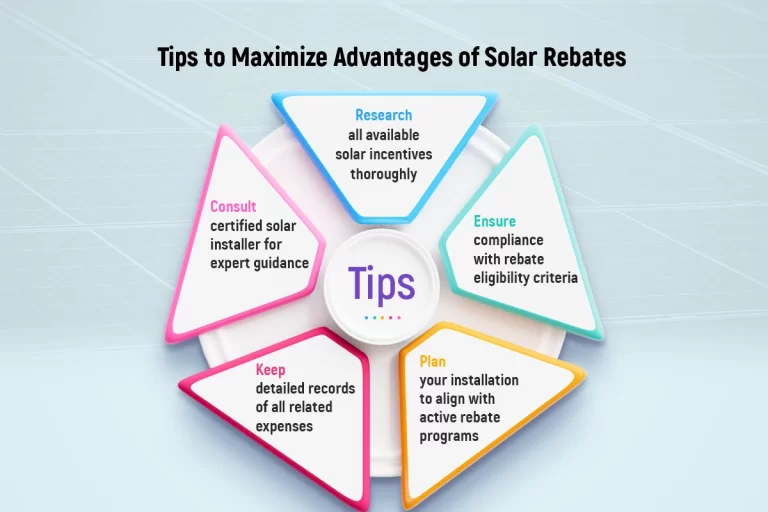

Some solar incentives often come with specific requirements, like you can only choose particular equipment, or there may be a home energy system size cap. Also, remember that you may not always receive the rebate immediately. It may be directly sent to your solar installation company, and they can deduct the cost from your total system cost. To get the best deal, choose a local solar installer near you. Here are some tips to take maximum advantage of your state solar rebate programs.

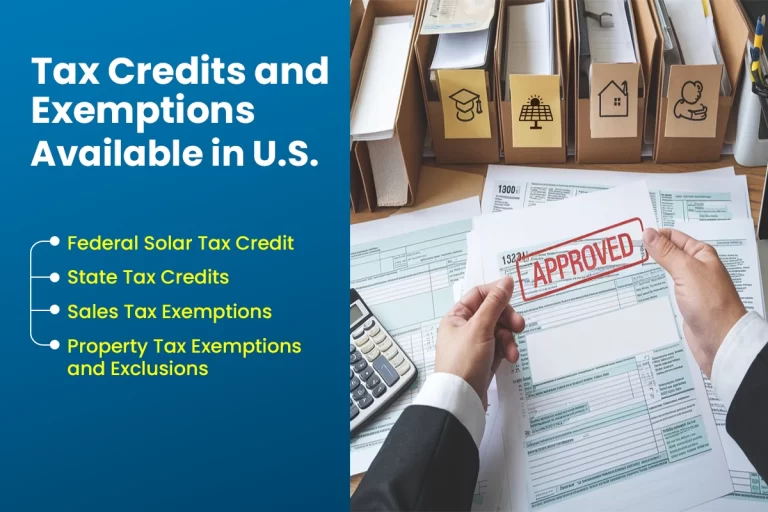

What are the tax credits and exemptions available to offset the initial solar installation expenses?

The federal solar tax credit is a great solar incentive from the federal government to support clean energy adoption. Also, some of the best solar states provide statewide tax credits to their residents to promote solar installation and clean power production. As the tariff increases on solar panels and accessories, these tax credits will play a prominent role in mitigating high equipment costs.

Federal Solar Tax Credit:

The Residential Clean Energy Credit, formerly known as the Federal Investment Tax Credit (ITC), allows you to claim 30% of the costs of your solar system as a credit from your federal income taxes. All project expenses are covered, including labor, equipment, permits, and more. For example, if your solar installation costs $20,000, you can deduct $6,000 from your tax liability. You can claim the credit for your operational solar energy systems between 2022 and 2032, after which it is expected to reduce gradually.

State Tax Credits:

By installing solar, you can receive a tax credit on your state tax payment in addition to the ITC. Some states only allow it to apply to equipment, while in others, all installation costs qualify, like with the ITC. Also, you can roll over any remaining unused credits for several years.

Sales Tax Exemptions:

Many of the best solar states provide tax exemptions to reduce the overall cost of installing a solar system. These tax exemptions exclude solar equipment from sales tax, leading to affordable solar technology.

Property Tax Exemptions and Exclusions:

In many states, installing home solar panels is also free from property taxes, so you won’t be charged for the additional value the panels add to your home. Although they vary from state to state, property tax benefits often come in conjunction with sales tax exemptions.

What are performance-based solar incentives?

While it’s great to get a return on your initial solar investment, earning with your home PV system makes solar a smart investment. Performance-based incentives (PBIs) are rewards that depend on the amount of energy produced by a solar system over a specific time (measured in kWh). Payments may come in monthly, yearly, or on other custom schedules.

Additionally, they may be used in addition to net metering or other solar buyback plans. PBIs are great because you don’t have to sell them in a market. Incentives are also often set at the time of system installation and do not change with market conditions.

How do net metering, net billing, and other solar buyback programs work to shorten the solar payback period?

Net metering is one of the most vital residential solar programs. You can effectively use the grid as an energy bank if your utility company or state allows net metering. In return for credits, you supply extra electricity to the electrical grid. The credits you have accumulated over time will be deducted when you use grid power in outages or at night. At the end of your billing period, your utility will only charge you for the “net” amount of used energy. Sometimes, if your utility lets you roll credits over between billing cycles, you may get a $0 bill or a credit balance.

Some states, like Arizona, offer net billing programs instead of net metering. You still receive credits for supplying power to the grid with net billing, but the value of the credits is lower than the retail rate. Also, in some states like Texas, utilities offer solar buyback plans for sending excess power to the grid. These incentives all aim to reduce the solar payback period and return on your investment.

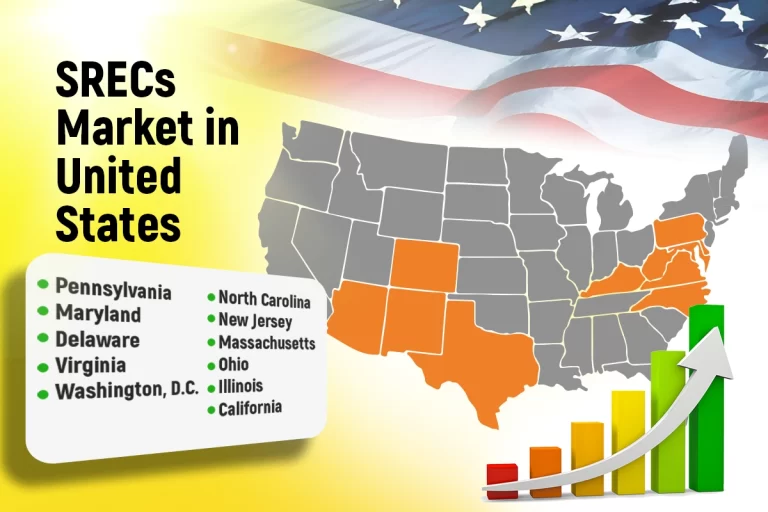

How do SRECs work to maximize solar savings?

Solar Renewable Energy Credits are one of the popular solar incentives in various states, including Maryland, Virginia, Pennsylvania, Delaware, and Washington, D.C. As a homeowner, you can earn 1 SREC for each 1,000 kWh (megawatt-hours) of power your solar system produces. You can sell SRECs directly to the utility or in the open market through SRECTrade. The price of renewable energy credits varies by state and over time. Like in Washington DC, the value of SRECs is high, often ranging from $300 to $400 per SREC.

How do subsidized solar loans and grants make going solar affordable?

The government and some non-profit organizations provide solar grants that cover a significant part of the cost of a solar installation. These grants are often provided to low-income homeowners. On the other hand, subsidized loans are often more accessible and have longer payback periods and lower interest rates. However, some solar loans are specified to lower-income households or require a specific credit score and debt-to-income ratio.

In times of booming inflation and increasing solar tariffs, installing solar energy systems is still a worthy investment. With solar incentives and rebate programs available in your state, you can still mitigate the high solar installation costs. These solar programs make renewable energy a cost-effective and more affordable option for your home or business. Additionally, you will not only lower your energy bills but also earn with excess solar power and maximize solar savings.

Book a FREE consultation with a trusted solar installer near you, like Solar SME, to explore the best solar rebates in your area and start your solar journey before the good incentives expire.

Related Articles:

Are you thinking about going solar in Arizona? With SunWatts Renewable Energy Rebate Program, you can cut off solar installation costs and start your journey towards savings instantly.

If you live in North Carolina and want to reduce your high energy bills, we have good news for you. Duke Energy is implementing a new Home Solar.

Are you considering switching to solar? Solar systems are clean, reliable and efficient to generate renewable energy for your home.