- Published On: January 23, 2026

Prepaid Solar Leases & PPAs: A Modern Risk-Free Way to Solar Ownership

The biggest residential solar incentive, the “federal solar credit,” has expired, leading to a higher upfront cost to switch to solar. At the same time, electricity rates are continuously rising. Also, due to the aging grid and extreme weather conditions, power outages are also increasing in the U.S. In this scenario, owning a solar energy system may be challenging for a homeowner. Prepaid solar leases and Power Purchase Agreements (PPAs) have emerged as a modern alternative solar solution: pay less upfront and begin saving on energy from day one. With fixed rates and no maintenance responsibility, these solar solutions protect you from rising utility rates and power market volatility. As 30% solar incentive is no longer available for homeowners, these solutions offer a more affordable and accessible way to homeowners looking to reduce their grid dependence and electric bills.

In this article, we will explore how prepaid solar leases/ppa works and what the important considerations are before choosing such solar plans.

What is prepaid solar lease/PPA financing?

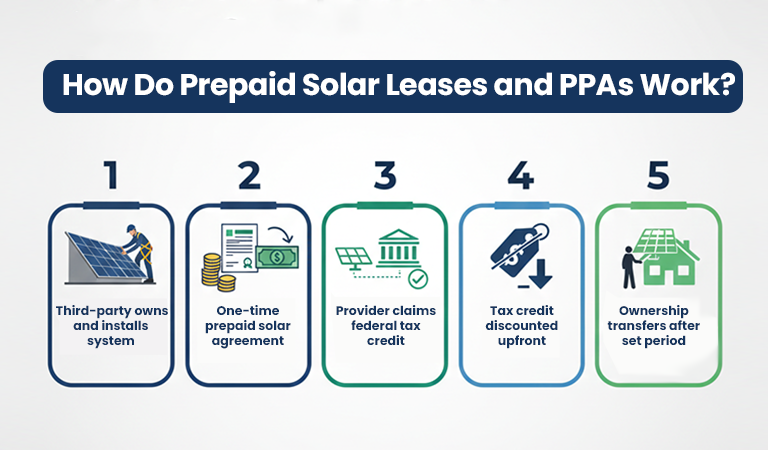

In a prepaid solar lease, a third-party owner claims the tax credit and maintains the system. The homeowner only pays the solar upfront cost with 30% off, like a federal tax credit. In exchange they get long-term solar energy production. They also have option to eventually own the system after some years with no additional cost. Many homeowners are looking for ways to take advantage of the business-claimed solar tax credit without being locked into a 25-year lease or PPA. This approach offers a fast-growing alternative that benefits from a federal tax credit and a path to ownership without the long-term commitment.

How do prepaid solar leases and PPAs work?

In a prepaid solar lease, or PPA, a third party takes ownership of the system. They claim the tax credit, and commits to monitoring, servicing, and maintaining the solar system. On the other hand, the homeowner prepays the cost and has the system transferred to them after six years. The pre-payment option, usually at or near 70% of the installation cost. This offers an offset equal to the value of the tax credit, which homeowners are no longer able to obtain on their own. For example, if the system costs $30,000, the company receives a tax credit of $9,000. The company could discount part of all of that credit into the system price the homeowner pays upfront. This allows homeowners to enjoy energy savings and tax credit benefits while also having the option to transition into ownership of the system after a certain period, typically 5-10 years.

What is the difference between a prepaid solar lease vs prepaid PPA?

Although both solar financing options are quite similar, PPA payments depend on the system’s power generation, which fluctuates regularly. On the other side, solar leasing payments are based on a fixed monthly payment to lease the equipment. However, the availability of leases and PPAs varies. The U.S. tax code allows for prepaid PPAs and leases as long as they are compliant with the statutory requirements.

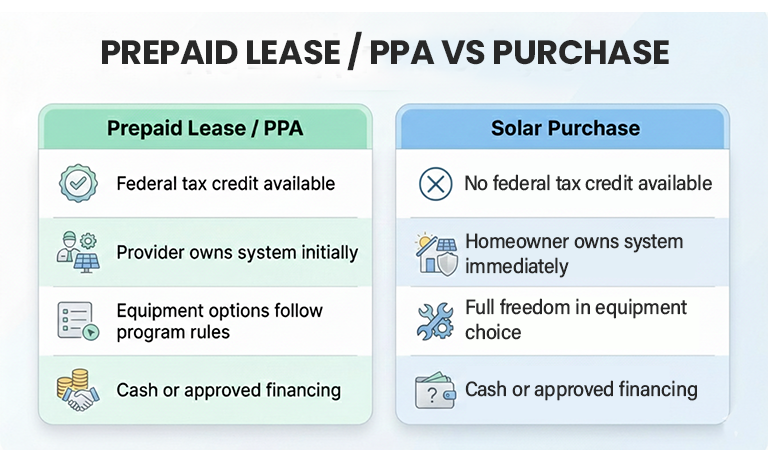

Prepaid Solar Lease vs Purchase: which solar financing option is better in 2026?

Owning a solar energy system is always the best option for maximizing the benefits of clean power. But in 2026, as FTC is no longer available, prepaid lease financing is a smart way towards ownership. Prepaid solar leases allow the third party, like a company, to claim and benefit from the ITC. But if a homeowner purchases a system, they own it from the start. However, homeowners will not be able to claim FTC in 2026, which is why prepaid leases have become popular.

What are the important considerations for prepaid solar lease/PPA programs?

For homeowners thinking about the prepaid option, there are two major factors to take into account.

The first is the choice of equipment. The system must adhere to the 48E Clean Electricity Investment Credit laws. It includes limitations on Chinese equipment known as FEOC, because the third-party owner is claiming the tax credit. This means, as a homeowner, your ability to select your preferred solar brands may be significantly limited by the “approved vendor list” of the third-party owner.

The next factor to take into account is whether the lender is aware of the prepayment arrangement and is confident in their stance regarding the loan’s collateral. Some lenders have entered into contracts with homeowners, and then demand full payment, charging breach. This can place a homeowner in a miserable situation, which is why you should have a written contract stating that the lender is aware of the identity of the prepaid counterparty and that they approve of this arrangement.

In conclusion, for homeowners who want to own their solar panel system while maintaining the tax credit eligibility of their project, prepaid solar leases are the best option. Unlike a traditional lease or PPA, they forgo the 25 years of maintenance and guarantees, but the trade-off is greater savings and little to no restrictions on property transfer.

Solar SME is a trusted solar installation company near you. We offer the best solar and backup solutions with flexible financing options. Our prepaid lease program helps homeowners take advantage of 30% off upfront with ownership in 6 years. You can get a FREE Quote or contact us to explore our solar financing plans.

Related Articles:

30% federal tax credit is expiring in 2025. But if you missed out on it, you can still access solar power with Solar Lease/PPA financing. This option is an opportunity to get all the advantages of solar power while making no large initial investments. Explore More!

Installing a solar energy system is a costly investment, but the good news is that there are several solar financing options to fit your budget and financial goals. Lets explore each financing option and its pros and cons to help you in the decision-making process.

It may require an upfront cost to install solar panels, however, there are various solar financing options. Explore the best option . between solar lease vs buy and make an informed choice.