- Updated On: September 11, 2025

Solar Installation Cost, Incentives &

Tax Credits in Arizona

Arizona is the sunniest state overall in the country, and residents get over 300 days of sunshine every year. This offers a great opportunity for homes and businesses in Arizona to reduce their high energy costs and maximize grid resilience with Arizona solar installation. On average, Arizona residents spend about $239 per month on electricity. By installing solar panels with a reliable battery backup, you will not only get up to 95% lower electric bills but also grid independence. Also, the federal solar tax credit and Arizona solar incentives help to minimize the upfront cost of a solar system. If you buy a system with cash, the upfront cost may be a bit higher, but the investment is worth it in the future as electricity costs are rising every year.

To help you decide whether you should go solar in Arizona, we will highlight all the major considerations, including the cost and benefits of solar installation in AZ. Also, we will uncover the best solar incentives and rebates in Arizona available for minimizing your upfront cost.

How solar helps you save on electric bills in Arizona?

Multiplying the average monthly consumption by the average electric rate yields the average monthly electric bill. For residential users in Arizona, it is $239. The average Arizona resident will require a 9.8 kW solar panel system to offset 100% of their yearly electricity consumption of 18,000 kWh, depending on the state’s sunshine hours and intensity. We know electric bills add up over time, and going solar in Arizona is a great way to save money.

Although buying a solar panel system with cash is the best option for availing all the benefits, like 30% federal tax credit, Arizona solar incentives etc., there are flexible financing options too. Solar loans may help you to install your system with very little upfront cost. Your system is owned like a cash purchase, but you pay for it in monthly installments like a lease. Also, if you don’t want to buy solar or your roof is not good, you can still take advantage of low electric bills with the PPA financing option. You will not own the system and be eligible for the solar incentives, but you can use solar power to reduce your high electric bills.

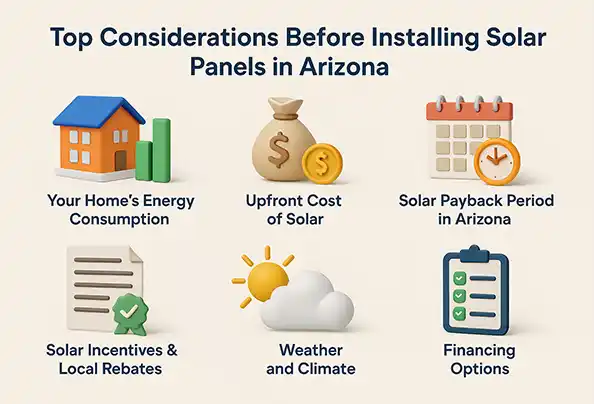

What are the top considerations for Arizona solar installation?

If you live in a sunny state like Arizona, there is no doubt that solar panel installation is a great option for you to save on your energy bills and get yourself free from the long power outages during bad weather conditions. However, not one-size-fits-all system fits all. It is vital to do a home energy audit and design a tailored system to maximize the benefits of solar power. The top factors you should consider while going solar in Arizona include:

What are the best solar incentives in Arizona for solar installation?

Buying a solar panel system in Arizona may seem costly, but the federal tax credit and Arizona solar incentives can help you minimize the upfront cost and save thousands on solar investment. The top Arizona solar programs include:

Residential Clean Energy Credit

The Residential Clean Energy Credit can lower the cost of your solar panel installation by 30%. It is also known as the Federal Tax Credit. This incentive applies to your entire system, including sales tax, labor, permits, and equipment. For example, if your system cost is $10,000 in Arizona, you will save around $3000 with the 30% tax credit, and the final cost will be $7,000. However, on July 4, 2025, President Trump signed legislation that eliminates the residential solar tax credit entirely starting January 1, 2026. The elimination of this tax credit will increase the solar installation costs and solar payback period in Arizona.

Credit for Solar Energy Devices

The Credit for Solar Energy Devices is one of the simplest state solar incentives. Residents of Arizona will receive a credit towards their state income tax bill equal to 25% of the cost of their solar panel installation, up to $1,000. The system can be installed on either your primary or secondary residence, but you can only claim $1,000 per year. Also, you can roll over unused credit for a maximum of five years.

Energy Equipment Property Tax Exemption

Solar installation not only helps you with lower power bills and grid independence but it increases your home value. According to a recent study, installing solar panels can boost your home value up to 14%. Typically, such upgrades would result in higher property taxes. Fortunately, solar panels do not increase your property’s tax value in Arizona. So, if we assume the typical house value in Arizona is approximately $441,500, and the effective property tax rate is approximately 0.63%, the solar property tax exemption can save you almost $189.

Solar Equipment Sales Tax Exemption

Solar energy equipment and its installation by certified solar installers like Solar SME are exempt from sales tax in Arizona, according to the Department of Revenue. However, solar battery storage and other accessories that aren’t a part of the original solar power system are not covered by the exemption. To qualify, your solar installer must register with the Arizona Department of Revenue (ADOR) .

Are there any local solar rebates in Arizona?

Additionally, there are local solar rebates available in some parts of Arizona that enable taxpayers to save even more money. The majority are managed by local utility companies. The following are some Arizona solar rebates:

Mohave Electric Cooperative SunWatts Renewable Energy and Rebate Program

The SunWatts Renewable Energy and Rebate Program is available to Mohave Electric Cooperative customers. You can receive $0.05 for each watt of solar power you intend to install in your home, up to $2,500, under the SunWatts incentive. In Arizona, the typical solar panel system is 7 kW, or 7,000 watts. This means the typical Mohave Electric customer can earn about $350 through the rebate program.

City of Scottsdale Green Building Incentives

To encourage new green building projects, the City of Scottsdale provides benefits such as renewable energy system permits, homeowner’s manuals, instructional materials, and technical help. Even though none of these offer immediate financial benefits, over time, the value they provide in the form of improved energy efficiency could result in significant cost savings. Although they are largely targeted at commercial solar, these incentives apply to both residential and commercial projects.

How does Arizona’s net billing program work?

Similar to net metering, net billing in Arizona also involves sending excess power back to the utility grid and earning credits. In terms of how much the utility must pay you for that excess solar energy, net billing and net metering are different. Utilities buy extra solar power for an “excess generation credit rate” under Arizona’s net billing program, which is less than the retail value of energy. Therefore, your utility may only pay you $0.08 for each kWh of solar energy you supply to the grid if they charge you $0.10 for each kWh that you use. Each utility plan may differ, so it is essential to compare the utility rates and plans.

Do incentives make solar worthwhile in Arizona?

Solar panels can produce a lot of electricity in Arizona because it is one of the sunniest states in the United States. Also, federal tax credits and solar incentives help reduce the solar upfront cost. Keep in mind that the 30% tax credit is only available until December 2025. However, as inflation is rising and utility rates are becoming higher day by day, solar will still remain a worthy investment even after the tax credit expires. Furthermore, to optimize your electricity bill savings, you can combine your solar panels with battery storage. By storing your solar energy for later use, you can reduce the amount of power you purchase from the utility grid and boost your energy independence, which will further cut your electric bill.

To make sure you get the best deal on solar panels, you need to find a solar installer that you trust. While the cheapest quote might sound the best, you don’t want to sacrifice installation quality. Solar SME is a trusted solar installer in Arizona. We offer tailored solar energy systems and backup solutions according to your unique requirements. You can get a FREE Quote with our smart solar calculator!

Hurry! Arizona is the best state for solar & the chances of availing 30% lower solar costs are running out. Plan your solar installation now for grid independence, no electric bills, and a clean energy future!

Related Articles:

Solar net billing in Arizona is also a compensation program for solar owners who transfer the excess solar energy to the grid. When your solar panels in Arizona overproduce power on sunny days, you can earn credits from your utility by flowing extra power to the grid. In this article, we will take you through the ins and outs of net billing in Arizona so you can make informed decisions.

Every year, more people choose solar panels for their homes and businesses. Homeowners can benefit financially from solar energy in most cases, however state-by-state variations in this regard can be significant. Explore the best states for solar installation!

The “Federal Solar Tax Credit” is one of the most valuable federal incentives that helps you to cut your PV system cost by 30%. However, it is only available till December 31, 2025. So, now is the best time to switch solar with low installation cost. Explore more!