Bloomberg NEF report shows that in 2022, the surge in the global energy storage market breaks all previous records. The market has seen a rise of almost 68% from the last year, with capacity addition of 16GW/35GWh. The global energy market is still burgeoning at a whopping 23% compound annual growth rate. The forecast for total annual inclusion is 88GW/278GWh, which is 5.3 times more than the 2022 installations. Several global markets have set their energy target this year which equates to about 130GW. Governments across the globe are also providing subsidies to support the cause. However, this brings forward the underlying problem of battery pricing around the world.

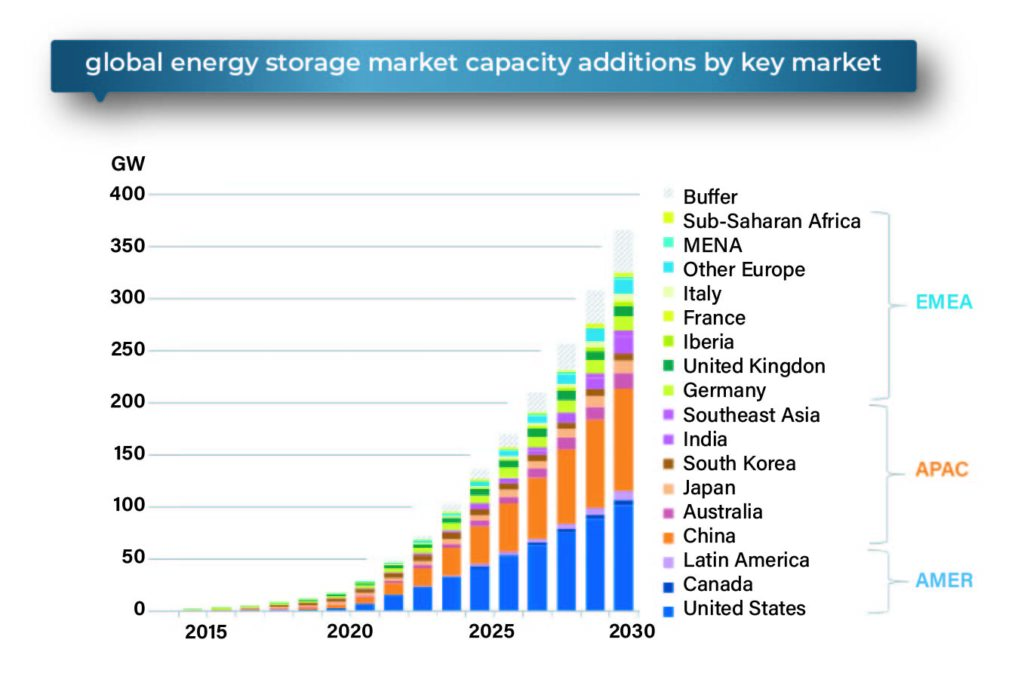

According to the BNEF depiction, China is to override the U.S. in terms of the global energy storage market till 2030. The country is working in terms of new provincial energy storage targets, power market reforms, and industrial expectations. This hopefully will hike up the storage capacity of China.

Conversely, the project delay in the U.S. storage market is bringing the country on the back foot. For example, in 2022 the utility-scale storage project of 7.2GW/18.4GWh was delayed due to inflated battery prices and supply chain complications.

Moreover, major energy storage programs are likely to procure the top status back to North America. These programs include market reforms in Chile, fast pace influx towards solar and wind energy in Brazil, and Mexico’s underinvestment in the grid electricity.

The U.S. represents the largest share of the North American energy storage market. However, North America will likely grab 21% of the global energy storage market by the end of 2030.

In the same way, Europe, the Middle East, and Africa (EMEA) are also jumping on the wagon of storage capacity. The total addition of the EMEA region in new storage assets was about 4.5 GW/7.1GWh last year. Due to high electricity prices and government incentives, there is also a hike in residential battery installations and this is likely to sustain till 2025.

Due to the high cost of batteries, the government is incentivizing companies to develop more economical options like LFP. Lithium iron phosphate batteries are inexpensive as well as more durable. China has currently chokehold in this market. This is likely to sustain till 2026, afterward the sodium ion batteries will finally gain traction in the global energy storage market.