- Published On: February 05, 2026

Solar Loans: Financing Terms, Interest Rates & What to Expect

As the residential clean energy tax credit has expired, owning solar is becoming more challenging for many households. There is a need for smarter and more flexible ways of harnessing clean energy without significant upfront costs. With changing incentives and rising energy costs, solar loans are revolutionizing the way households access solar energy. With solar loan financing, homeowners can now use solar energy at their homes and comfortably pay for it over time. Unlike before, when you would wait for years before transitioning to solar, you can now do so with structured payment plans.

In this article, we will explore solar loans in detail. We will analyze their features, types, and the pros and cons. Furthermore, we will share some useful tips for choosing a loan plan for your home.

What is a solar loan?

With no upfront costs, solar loan allows you to take ownership of your system and gradually pay it off. To finance a solar panel system, you take out a loan from a bank or other lender and commit to repaying it over a predetermined time in monthly installments with interest. However, you get immediate ownership of the home solar system, just like with a cash purchase, making you qualified for utility net metering and solar incentives. Like other long-term loans, specific solar loans also require a good credit score history.

What are the main features of solar loans?

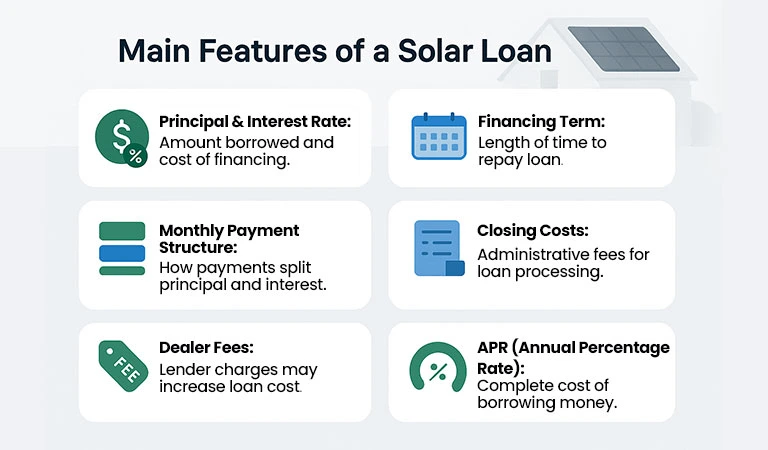

Principal Amount & Interest Rate

The total amount that you borrow to pay for your solar panel system is known as your principal; it does not include interest, which is a proportion of the principal that your lender charges you for borrowing money. Your monthly payments will cover your interest and part of your principal, depending on how your loan is set up. To pay it off more quickly and reduce the interest you owe over time, it is worthwhile to ask your lender if you can make payments that only go towards your principal balance.

Financing Term

Financing term, often known as “loan term,” “loan length,” or “loan contract,” describes the duration of your loan or the time you will be making payments. Although most solar loans allow you to repay your debt early without incurring penalties, their maturities typically span 10 to 20 years. Your interest rate, monthly payment, and the total amount you save by switching to solar power depend on your financing period. Longer loan terms result in higher interest over time, which depletes your savings.

Fees

Like most loans, solar loans may come with charges like closing costs. Unlike other types of loans, though, it often has dealer fees, similar to an origination fee for a mortgage. These fees can be flat or a percentage of your total solar loan amount.

Dealer fee:

Solar lenders may charge a premium to cover their lending risk; this is sometimes referred to as an initiation fee, loan fee, or lender fee. The dealer charge will differ based on the loan provider because there is no industry standard. The cost of your loan is greatly increased by dealer fees, which can account for up to 30% of the entire cost. If the dealer fee is too expensive, you can look into taking up a home equity loan, HELOC, or a personal loan that doesn’t impose origination fees.Closing costs:

Sometimes, your solar loan may have closing charges to cover the cost of your provider administering and servicing your loan.

APR

The most important factor to consider is the annual percentage rate (APR). It is a percentage that accounts for both the interest rate and the fees. The APR gives you a more complete view of what you are actually paying to borrow the money.

Your interest rate, fees, loan length, and solar panel cost will all affect how much your loan actually costs. Your monthly payments will be lower if you take out a longer loan term, but you will pay more interest. You will save more over the long term if you can afford big monthly payments.

What are the main types of solar loans?

Like any other financial option, solar loans come in formats with distinct terms, restrictions, and structures. Let’s examine some factors that you should take into account while selecting a solar energy loan.

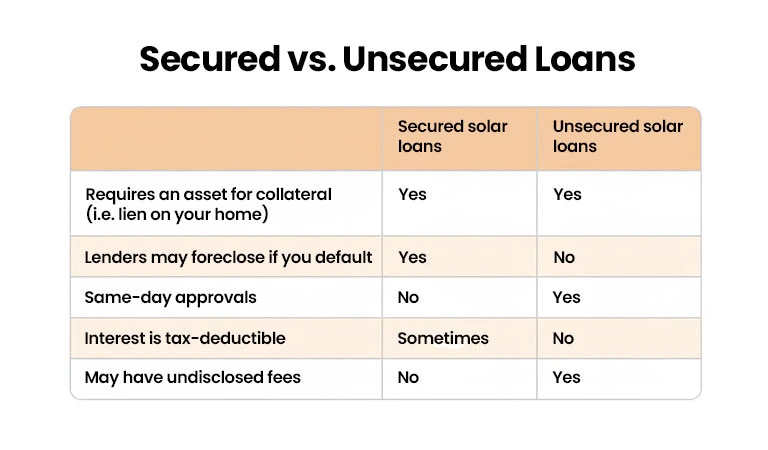

Secured vs. Unsecured Loans

The majority of loans fall into two broad categories: secured or unsecured loan. Although secured loans typically offer lower interest rates, they do require an asset to serve as collateral. In most circumstances, that asset will be your home. It means your lender may seize your home to pay them back if you default on your loan for whatever reason. Conversely, unsecured loans typically have higher interest rates but don’t require any security other than the solar equipment itself.

Amortized vs. Re-Amortized Solar Loans

Your solar loan will either be amortized or re-amortized.

- The majority of secured loans have predetermined terms and monthly payments because they are amortized.

- Most unsecured solar loans are re-amortized, which means that after a predetermined period of time (often one year), you make a lump sum payment, following which your payments decrease.

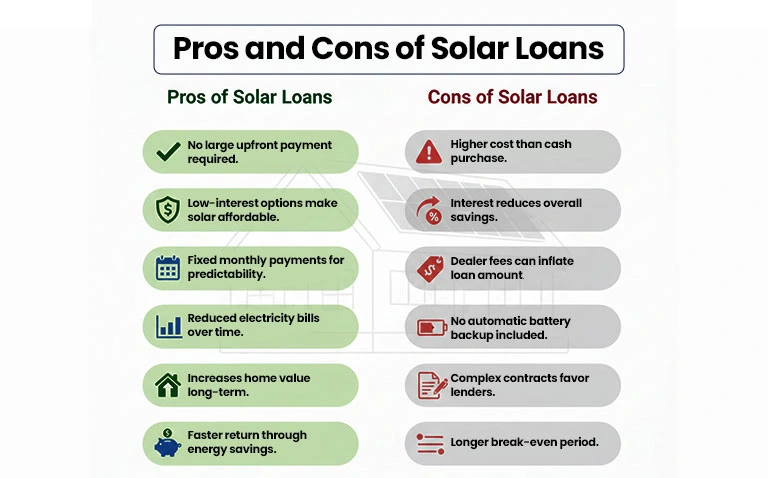

What are the pros and cons of solar loans?

Some major benefits and disadvantages of a solar loan include:

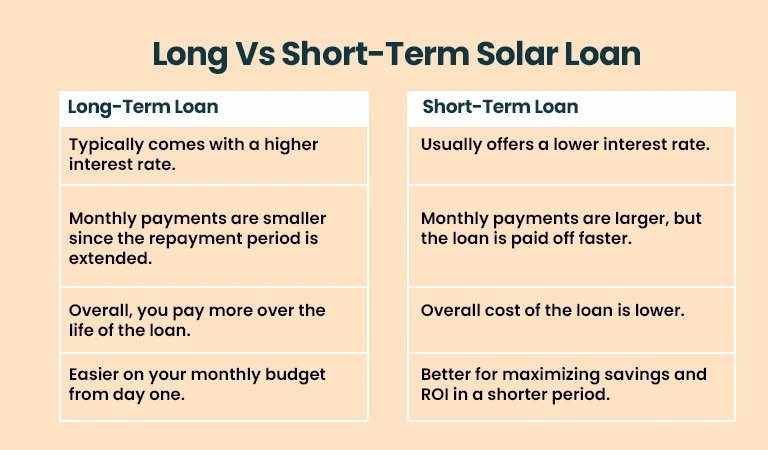

Long- or Short-Term Loan: Which should you choose?

Some homeowners opt for a longer loan term to keep their monthly expenses low and pay off the loan when they have the funds available. But before taking this approach, it’s important to check whether your lender charges a prepayment penalty.

How to choose the best solar loan for you?

You can easily optimize your solar savings by selecting the best solar loan. You need to make sure that what costs you are responsible for, when to pay them, and how they affect your overall payment structure and payback time. Find out from your lender if the fine print contains any additional costs. Here is a checklist that you may use to enquire about your solar loan with your installation or lender:

Difference in the Cash Price

The amount you are paying in fees and additional loan costs is the difference between the cash price and your solar loan quote. To make sure you receive the best bargain, it’s good to find out the cash pricing from your installer before choosing how to finance your system. If you can pay in cash, you will pay less overall for your system as you avoid any interest and additional loan fees. It allows you to reap the benefits of your solar savings more rapidly than if you finance your system. To reduce the initial cost, you should also check all state incentives and rebates. Cash purchases give you the biggest lifetime savings, but they also hold up significant cash that you might want for other investments.

Interest Rate and Loan Terms

Confirm the length of the loan and the interest rate that you will be paying. Make sure you are aware of any changes to your payments over the course of the loan. If your loan is re-amortizing and your lender anticipates a lump sum payment that will lower your principal, you may occasionally see larger monthly payments listed for the first year or so of the loan term.

Additionally, you must verify that your loan has a fixed rate. If interest rates rise, you might have to make larger monthly payments if you take out a variable-rate loan.

Loan Fees

Confirm the fee you’re paying, whether an origination or dealer fee. Be cautious to read all the fine print in your loan agreement because dealer costs are usually baked into the cost of your entire solar panel installation and aren’t always easily evident. Again, make sure to ask your installer to show you both the cash price and the financed price; the difference exposes just how much you’re paying in fees.

Prepayment Penalties

Many solar loans are paid off earlier than the agreed-upon loan term, meaning many homeowners are prepaying their loans. This commonly happens when homeowners receive state tax incentives or refunds and use that cash to pay down the principal. Luckily, most solar loans don’t have a prepayment penalty, which is a charge for making payments on the principal of your solar loan and paying off your loan early. But it’s still smart to ask and confirm in any loan documents.

Going solar is a major investment with a significant long-term return. If you can’t pay cash for solar, there are solar loans to help you start saving. Solar loans are flexible because they typically require $0 down and offer loan terms between 8 and 20 years. This allows you to design a loan with a monthly payment that you are comfortable with, and essentially choose your own electricity rate. Solar SME is a local solar installation company near you offering best solar solution and flexible financing plans. Get a FREE Online Estimate with our smart calculator.

Related Articles:

A modern, risk-free path to solar ownership is Prepaid solar leases & PPAs. Enjoy predictable costs, hassle-free installation, and long-term energy savings while embracing clean, renewable energy for your home. Learn how they are transforming solar ownership while maximizing long-term savings.

Installing a solar energy system is a costly investment, but the good news is that there are several solar financing options to fit your budget and financial goals. Lets explore each financing option and its pros and cons to help you in the decision-making process.

Solar loans are a cost-effective solution for installing solar panels on your home or business. However, many are unsure about their functionality and the benefits they might derive from this type of solar financing.