- Updated On: October 15, 2025

Solar Lease/PPA: A Smart Financing Option

Without Upfront Cost

What is a solar lease?

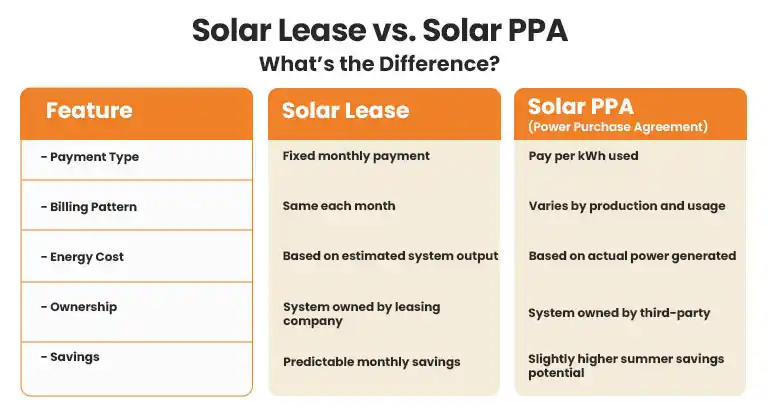

In a solar lease, you agree to pay the third-party owner a fixed monthly lease fee to use the solar energy system, installed by that company. This payment is usually lower compared to your energy bills, so you can switch to solar energy at no upfront cost. This trend is gaining popularity following President Trump’s announcement to eliminate the Federal Tax Credit this year. Solar lease financing allows more people to use clean power and mitigate the energy crisis without buying a solar energy system.

Also, once it is possible to buy the solar system directly from your solar provider at a retail price, once the lease contract is over, but this is not the best financial option because you will probably have to pay extra money. Furthermore, most lease agreements last 20-25 years and include a price escalator that may increase payments by 1-5% annually, but not necessarily. In addition, you will have to pay high early termination costs if you want to break your lease early, which will offset any initial savings from switching to solar power.

What is the difference between solar leases and solar PPAs?

What are the top advantages of solar lease/ Third Party Ownership?

Let’s analyze the benefits of leasing solar system:

- As the solar upfront cost is expected to rise after the tax credit expiry, the major benefit of solar leases/PPA is that you do not need to manage any initial investment for buying and installing solar panels. This makes solar energy accessible to people who may not be able to afford to switch to purchasing with a cash/loan option.

- As you are not the owner of the system, you are not responsible for any maintenance or repair. The leasing company will handle the repair of the leased PV system. This means that you can get advantages without having to bear additional costs.

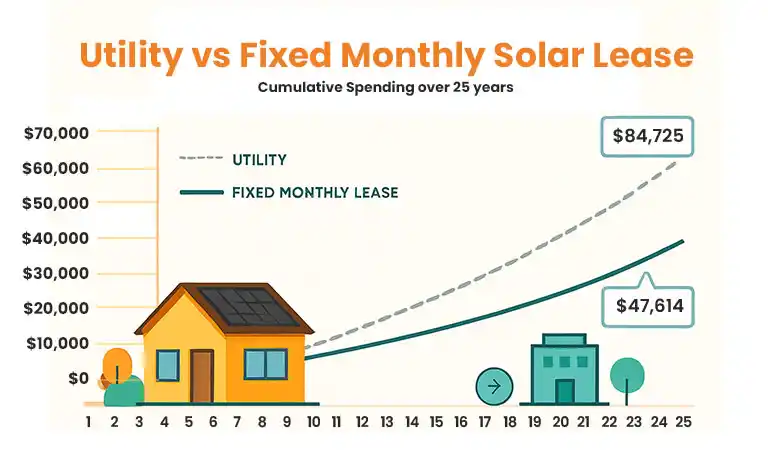

- Without solar, your monthly bills may fluctuate, but if you are utilizing solar power, you pay a fixed monthly payment, which is lower than your utility bills.

What does a solar lease/ PPA agreement include?

Annual Escalator:

These are common in TPO agreements; if it includes this, the leasing company can raise your monthly payment or rate per kWh every year. The smart move is to look for companies with low or 0 escalators to maximize your future savings.

Lease Tenure:

Residential solar leases normally last 20 to 25 years. However, commercial solar leases are tailored and typically last 7 to 20 years.

Maintenance of System:

The leasing company will check the system’s performance to ensure that it operates properly throughout the lease. They are also responsible for solar maintenance and repair services.

Solar Performance Monitoring:

Most solar leasing companies give you free web, smartphone, or tablet apps for tracking your solar panel system’s performance.

Buying the Leased System:

Many solar leases allow you to purchase out your solar panel system during the lease term, usually at a price specified in your contract or its fair market value.

Selling Property:

If you sell your home, you can either transfer the remainder of your lease to the buyer or purchase the system from your leasing company and include it in the sale. Your potential home buyer will have to go through some sort of credit check.

Completion of Lease/TPO Agreement:

When your agreement ends, you can either buy the system outright, have the leasing firm remove it, or leave it in place and renew the arrangement with the owner.

How to compare the top solar lease companies?

When you compare several companies for leasing agreement, you must consider:

Business Model and Primary Product:

Companies that offer solar leases gain profits by financing a solar panel system for your house and then selling you the electricity generated by the panels. Most of the time, the firms guarantee that you will save money on your electricity bills during the first year, which is advantageous for both parties. Also, each company has a different background, but most began with financing in mind from the outset. Others started as equipment manufacturers or installation companies.

Partnerships with Solar Installers:

It is essential to search about whether your leasing company also takes care of solar installation or they are partnered with local solar installers for installing solar panels. You should consider the one with a certified solar installer for an efficient system.

Financing Source:

It’s a long-term investment for the company that finances that system as they make money from the interest you pay them each month. Big banks and security firms have also started financing for solar as the cost of solar equipment continues to decline. However, before signing a contract, you must make sure that the financing source is authentic and is not a scam.

Solar Panels and Equipment:

You can only benefit from solar power if you have a solar panel system consisting of high-quality solar panels and equipment. A cheap system may not fulfill your energy goals. So, it is vital to check which solar panel brands and equipment will be used for your installation.

Customer Reviews:

Before deciding to work with any company, do some research and check customer reviews to ensure that you are in the right place.

Solar leasing is a good way for homeowners and businesses who prefer shifting to solar energy without paying a large amount of money for installation. Simplifying the process and providing predictable monthly payments, it makes renewable energy more accessible for everyone. By understanding the leasing process, and evaluating financial implications, you can make an informed decision.

In conlcusion, as solar energy systems costs are expected to rise, solar lease/PPA is a good way for homeowners and businesses who prefer shifting to solar energy without paying a large amount of money for installation. If you are looking for solar financing options, Solar SME is here to help. Our energy experts assist you in making a suitable choice for your budget and needs. Book your consultation or get a FREE Quote with our solar calculator.

Related Articles:

Installing a solar energy system is a costly investment, but the good news is that there are several solar financing options to fit your budget and financial goals. Lets explore each financing option and its pros and cons to help you in the decision-making process.

Among the renewable energy sources, the most trending one is solar energy. But the question is, are solar panels worth it? Solar systems for homes are reliable systems.

It may require an upfront cost to install solar panels, however, there are various solar financing options. Explore the best option . between solar lease vs buy and make an informed choice.