Solar SME Pennsylvania

Leading Solar Installation Company

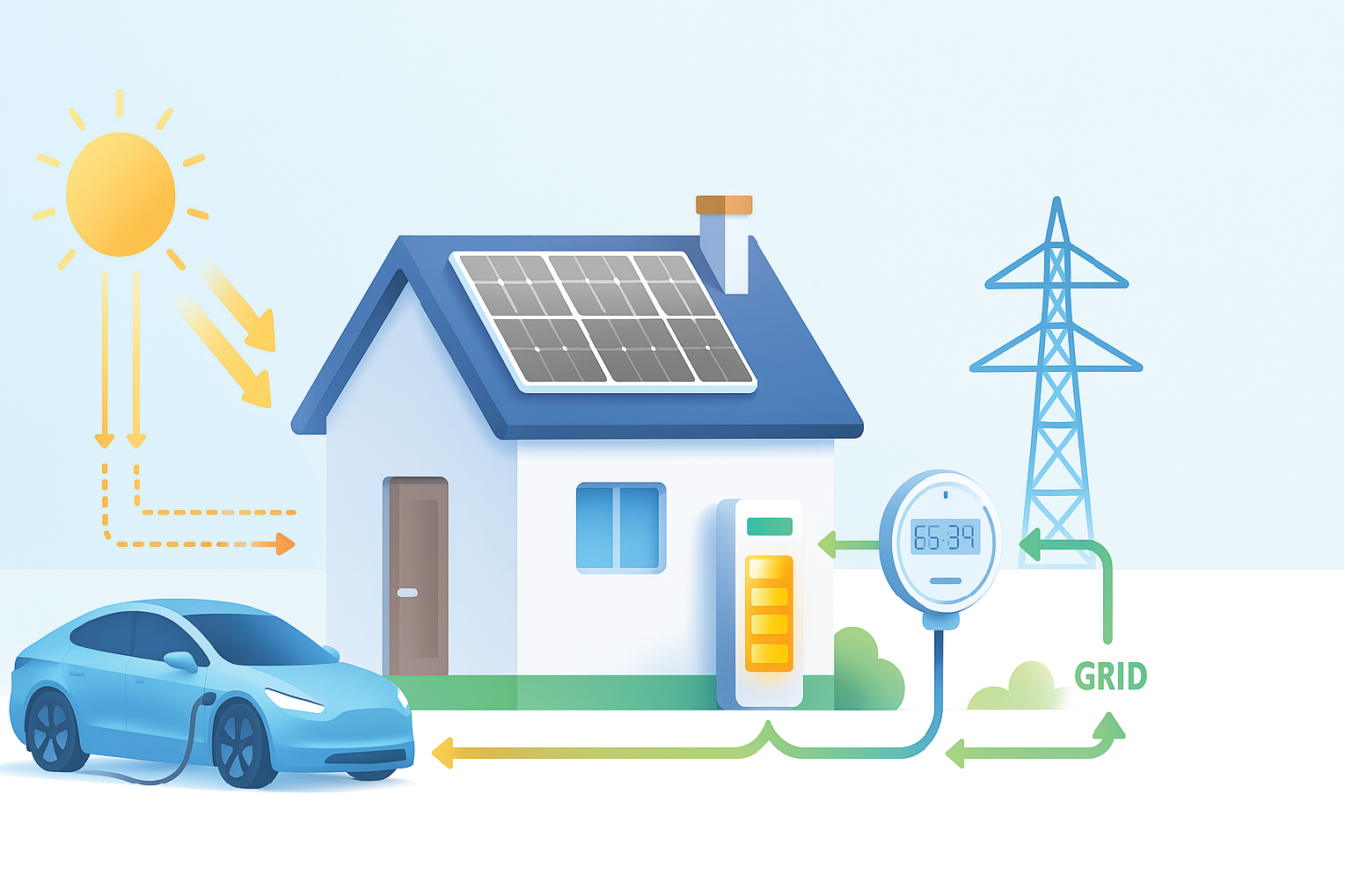

Enjoy reliable power all year with tailored solar + battery options

Solar power trend is booming statewide in Pennsylvania as people demand cleaner and more efficient energy sources. The solar panel cost in Pennsylvania has dropped 45% over the past five years, and going solar in Pennsylvania is 10% cheaper than elsewhere in the country. Meanwhile, outdated grid infrastructure has led to extended power outages that left over 7 million residents without power. These are the key reasons for homeowners and companies to invest in solar systems in PA for reducing carbon footprints, reducing energy bills, and supplying secure power even during outages in the grid. Solar panel installation in the state is no longer an option but is becoming the backbone of the state’s energy. Solar SME is a Pennsylvania-based certified solar installation company, which serves 11 states in the United States. We provide customized solar and backup power solutions according to your unique energy requirements.

How much can you save on electric bills with solar in Pennsylvania?

Over the next 25 years, you may expect to pay $104,800 in energy costs in PA. Solar helps you save money by lowering or eliminating your monthly electric costs. However, the cost of solar panels in PA depends on your system. An average home in Pennsylvania will require a 12.0-kilowatt (kW) solar panel system to offset 100% of its yearly electricity consumption of 14628 kWh. In Pennsylvania, installing a solar system will pay for itself in 9.96 years, at which point you may not owe anything on your electric bills. Also, adding solar battery storage will save you more, as you can send excess power to the grid and earn energy credits. Furthermore, with the Pennsylvania solar programs like PA Solar Renewable Energy Credits, you can sell your credits to the utilities and earn from them.

25-year Savings

$62,880

Payback Period

10 Years

84%

Solar Financing Options in Pennsylvania by Solar SME

Installing a solar energy system in Pennsylvania is a smart investment for your home or business nowadays. Although losing a 30% PA solar tax credit will increase the upfront cost, rising electricity rates, inflation, and climate-driven grid instability still reflect the value of solar. There are 3 main financing options for managing initial solar expenses.

The best option is to buy solar panels in PA with cash to maximize your savings. If you choose ownership, you do not require any loan paperwork, no interest calculations, no increasing lease payments, and no monthly payments after installation. Also, it will increase your home by 7%-14% and you qualify for the federal and other solar incentives in Pennsylvania.

If you want to own the solar panels system but do not have much cash, solar loan financing is also available for you. With solar loans, you will make fixed monthly payments for 5-25 years while benefiting from instant energy savings. Fixed payments provide cost predictability, unlike utility bills or lease escalators, which rise over time. Also, the Federal Reserve cut interest rates for the first time this year by 4% to 4.25%. With solar loan option, you can still qualify for all the state and federal incentives.

As the 30% tax credit is expiring, solar leases are emerging as the best alternative to take advantage of solar power. Third-party financing requires you to pay a fixed monthly lease payment or per-kWh rate (PPA) for the solar energy produced by the system. According to the U.S. Department of Energy, this rate is 10% to 30% lower than your electric bills. As you are not the owner, the federal tax credit and other solar incentives' expiry will not impact your savings. However, it is vital to choose your solar leasing plans wisely. Solar SME, the top solar provider in Pennsylvania, offers the best solar lease options for making your solar journey affordable.

Best Residential Pennsylvania Solar Incentives and Rebates

Pennsylvania offers some of the best solar and battery incentives and local rebates in the country. As the electric rates are surging every day, going solar can result in substantial savings. However, the federal solar tax credit will expire in 2025. Let’s have a look at the top solar energy programs in Pennsylvania.

01- Residential Clean Energy Tax Credit

The Residential Clean Energy Credit, also known as the federal investment tax credit (ITC), can lower the cost of a solar panel system by 30%. This incentive applies to the entire system, including equipment, labor, permits, and sales tax. However, on July 4, 2025, President Trump signed legislation that completely canceled the home solar tax credit beginning January 1, 2026, nearly a decade before its initial expiration date.

02- Pennsylvania Solar Renewable Energy Credit (SREC) Program

The state’s Alternative Energy Portfolio Standards (AEPS) compel utilities to generate a specific quantity of solar energy. As a solar owner, you can get one Pennsylvania SRECs for every megawatt-hour (MWh) of clean electricity your panels generate. You can sell these SRECs to utilities and use them to offset your renewable generation costs. However, the SREC pricing varies depending on market conditions, but you may expect to earn $30 to $40 per SREC in Pennsylvania.

03- High Performance Building Program (HPB)

High Performance Building Program (HPB) is among best Pennsylvania solar rebates. It offers loans and incentives to businesses and homeowners for the development or renovation of “high-performance building projects”. HPB grants cover 10% of total qualifying building construction or refurbishment expenditures. Homeowners’ primary dwelling projects may be eligible for a loan of up to $100,000 at a fixed interest rate. Eligible projects must meet or exceed the National Green Building Standards (NGBS), Green Building Initiative (GBI) Green Globes Standards, and United States Green Building Council (USGBC) LEED Gold Standards.

04- Philadelphia Solar Rebate

Is net metering available in Pennsylvania?

Under net metering in Pennsylvania program, you’ll receive credits at the retail rate of power for each kWh of electricity your system generates, up to 100% of your yearly utility electricity use. If you send more electricity to the grid than you consume over a year, you will be credited based on the “price-to-compare,” which represents the generation and transmission components of the utility’s retail rate but does not include distribution. The popular utilities for net energy metering in PA include PECO, PPL & First Energy Companies.

Commercial Solar Installation in Pennsylvania

Switching to commercial solar power in Pennsylvania is an effective way for businesses to combat all of the power challenges. Businesses can generate power using free and unlimited sunlight via commercial solar panels. Furthermore, using solar electricity combined with a reliable battery backup system like Tesla Powerwall 3 eliminates power disruptions. Hence, enabling smooth workflow and increased operational resiliency. Pennsylvania also offers business solar incentives and tax credits, which are another compelling reason to switch to low-cost clean energy options.

Like residential solar installation, you are also eligible for a 30% federal tax credit for commercial solar systems. Additionally, High Performance Building Program, MACRS Depreciation, and PACE Financing options are available for business solar installation.

Why is it Worth it to Switch to Solar in Pennsylvania?

Solar panels are an outstanding investment for most Pennsylvania homeowners, who end up saving tens of thousands of dollars in most cases. However, not every home is equally suited for solar conversion, so determining if your property is a good candidate is a important first step in your solar journey.

Low Electric

Bills

Maximum Grid Independence

Flexible Financing Options

Increased Home Value

Earn Energy Credits/SREC Programs

The best way to determine how to maximize your solar savings in Pennsylvania is to consult with a local solar installer. Solar companies near you can guide you with the best solar solutions and incentives in your area and can help you to get the most out of your solar investment.

Calculate your Solar Savings with Solar SME Smart Solar Calculator NOW!

Step 1:

Property Type

Step 2:

Financing Options

Step 3:

Enter Your Current Electric

Bill & System Preferences

Our Customers are Getting Up to 90% Lower Electric Bills with

Solar SME Tailored

Solar Solutions

Solar SME is a certified Pennsylvania solar energy company. We provide our valuable clients with an exceptional solar experience by designing solutions according to its customers’ unique needs. Also, we hold a positive image in solar marketplaces like Energysage. Moreover, we are accredited with BBB, and our happy customers highly recommend Solar SME for the best solar services in Pennsylvania.

City: Philadelphia

System Size: 12 kW

Annual Savings: $1,850

City: Pittsburgh

System Size: 10.5 kW

Annual Savings: $1,620

City: Allentown

System Size: 14 kW

Annual Savings: $2,030

City: Harrisburg

System Size: 9.8 kW

Annual Savings: $1,480

City: Erie

System Size: 11.2 kW

Annual Savings: $1,710

City: Scranton

System Size: 13.5 kW

Annual Savings: $1,960

Frequently Asked Questions

In Pennsylvania, solar panels are really worthwhile. Solar energy can save you money and pay for itself over time, even though the initial cost is an investment. Solar panels can offer both energy and financial security, especially in the historically high electricity costs in the majority of the United States.

Because of Pennsylvania’s net metering law, you can sell any excess electricity generated by your solar panels back to the grid and receive credits on your utility bill.

For every SREC generated by your system over the course of the year, you will receive credit from your SREC broker. For instance, you will produce 10 SRECs if your 10-kilowatt system generates 10,000 kWh a year. Your broker is the one who sells these credits, and you get paid for the sales.

Pennsylvania offers several solar incentives that are intended to help make the switch to solar power. The federal government’s Solar Investment Tax Credit is the biggest incentive available to Pennsylvanians, with state and local incentives.

Solar SME is one of the best solar providers in Pennsylvania. We specialize in providing reliable solar solutions tailored to your needs. Whether you’re interested in reducing energy costs or enhancing your home’s sustainability, our expert team ensure a seamless and efficient installation process.