Solar energy storage deployment is rapidly increasing across the US. A new report from Wood Mackenzie’s U.S. Energy Storage Monitor shows a 90% year-over-year increase in solar battery installations. Drastically lowering costs, improved supply chain efficiency, and booming demand for clean and renewable energy have fueled the storage boom.

Solar Energy storage breaks record in Q1 and Q4

The report highlights that the US has deployed 8.7 GW of solar batteries across all segments in the past years. In Q4 2023, the nation deployed 4.2 GW of solar battery storage. California and Texas lead the way with a 77% increase in solar installations. “Easing supply chain challenges and system price declines helped strengthen the U.S. energy storage market in Q4 2023,” said Vanessa Witte, senior analyst at Wood Mackenzie.

Grid-scale projects take the spotlight

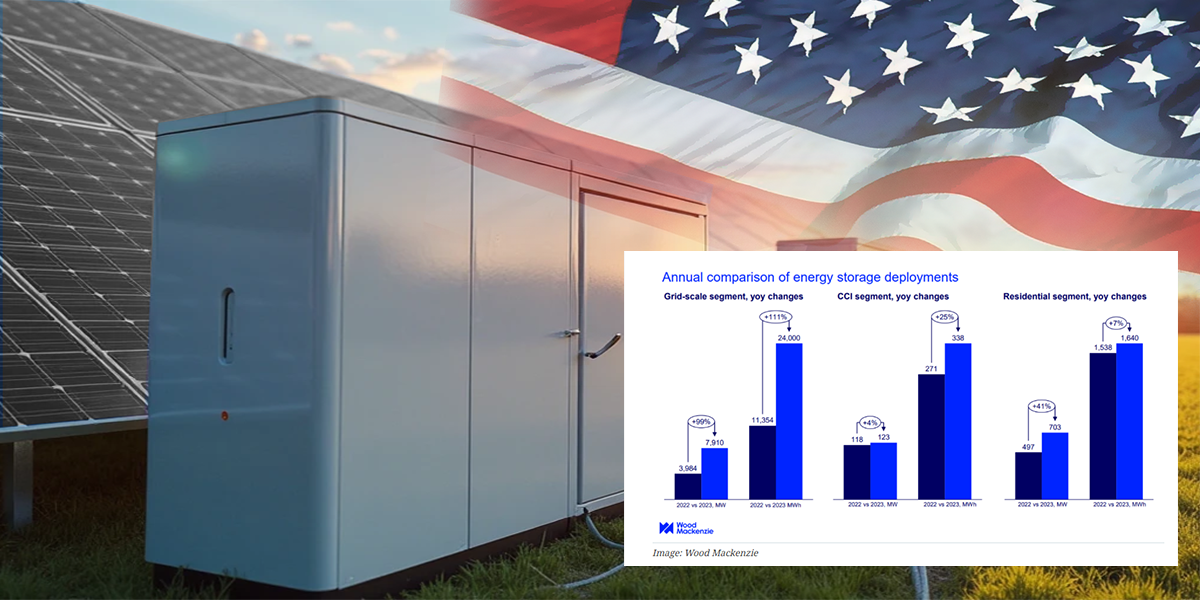

Grid-scale solar energy storage was the biggest contributor to this growth. The U.S. grid-scale storage market shattered previous quarterly installation records in Q4 2023, deploying 3,983 MW / 11,769 MWh. It leads to an average duration of 2.95 hours. These solar battery storage systems provide an electricity supply during peak hours and power outages. Furthermore, grid-scale batteries for solar panels show a rapid increase of 98% compared to last year. However, the experts at Wood Mackenzie alert that this impressive growth will not be seen in the coming years at the same pace.

Small and large-scale energy storage growth

The residential battery storage market also reached the milestone. With 218.5 MW installed in Q4, 2023, the home battery storage market hit a record of 210.9 MW set in Q3. This was a marginal record quarter for the market. States like California, Massachusetts, and New York lead the way, helped by local incentives. Meanwhile, the community, commercial, and industrial (CCI) segment added another 33.9 MW, with a majority of deployments in California.

Why is the solar battery backup industry growing?

One reason for the growth in storage is the decline in battery prices. Battery prices dropped in Q4. The drop is a result of an excess of raw lithium material for batteries and a lower-than-expected demand for EVs in the EU and the US.

Battery cell prices have fallen by nearly 50% since last summer, says CATL, the world’s biggest battery maker. According to Goldman Sachs, there will be a surge in demand for electric vehicles once their prices are lower than gasoline-powered vehicles.

What’s next for U.S. solar energy storage?

CCI is anticipated to install 1.2 GW each year. Meanwhile, residential storage could increase to 2.1 GW annually in 2024, says Wood Mackenzie. New storage incentive programs and California’s switch to NEM 3.0 will support this growth. Puerto Rico is also seeing strong demand for home batteries. John Hensley of American Clean Power says the future looks bright due to a large pipeline of planned energy storage projects.

To conclude, solar energy storage in the US is growing at a huge rate. With lower battery costs, improved supply chains, and local state incentives, more homes and businesses are investing in battery backup systems.

News Source: PV Magazine