- Published On:

New Solar Market Development Tax Credit For New Mexican Solar Owners

The New Solar Market Development Tax Credit (NSMDTC) is a great initiative for homeowners, and commercial and agricultural sectors shifting to solar in New Mexico. This tax credit is a financial boost to support residents in their solar investment. In NM, solar adoption is booming and the New Mexico solar tax credit plays a vital role in cutting solar upfront costs. For qualified systems, this solar tax credit 2024 offers savings of up to 10% of the solar installation cost. It is important to understand how this tax credit can maximize the benefits of solar incentives in New Mexico. Starting in 2024, this program is expanding with a cap of $30 million. So, if you are a homeowner or a business, the NM solar tax credit is for everyone switching to clean power in the state.

In this article, you will learn the eligibility criteria, the required documents, and the application process for the New Solar Market Development Tax Credit.

What is the New Solar Market Development Tax Credit?

The NSMDTC is a New Mexico state solar tax credit program. This aims to promote clean power adoption across NM. The New Mexico New Solar Market Development Tax Credit (NSMDTC) provides tax credits against the state personal income tax for solar system installations on New Mexico homes, companies, and farms. It covers up to 10% of the solar thermal or photovoltaic system’s installation cost. The maximum credit per taxpayer is $6,000 annually . Furthermore, the solar tax credit in New Mexico aims to make solar technology accessible to maximum people and promote a clean environment.

What are the eligibility criteria for the tax credit?

A taxpayer who has invested in and installed a solar photovoltaic or solar thermal system provided that:

The taxpayer must be an independent individual.

The taxpayer must have bought and installed a photovoltaic or solar thermal system on or after March 1, 2020, when the new solar market development tax credit became available.

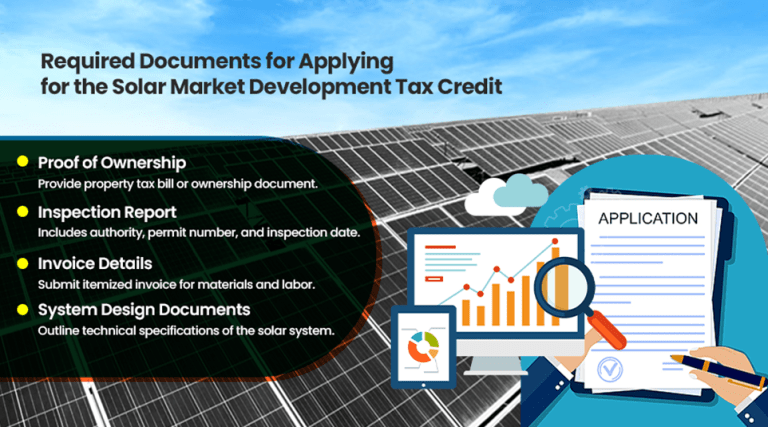

What documents do I need to apply for the New Solar Market Development Tax Credit?

You must use EMNRD’s online application site to apply for the New Solar Market Development Tax Credit. While filling out the application, provide all names, partnerships, and titles of property owners on the application. You need the following documents to complete the application.

A current property tax bill or other relevant documentation of ownership for the home, place of business, or farm where you have a solar energy system installed, in the applicant’s name.

The Building Code Inspection report must be on a hard copy, a photo of the inspection sticker, or an online report that uploads your permit as an attachment and includes the name of the building code authority, permit number, and date of successful inspection.

An invoice which must contain labor cost breakdown and cost of other equipment used for solar panels installation.

Detailed technical report and also the solar system design

Recent Updates In The New Solar Market Development Tax Credit?

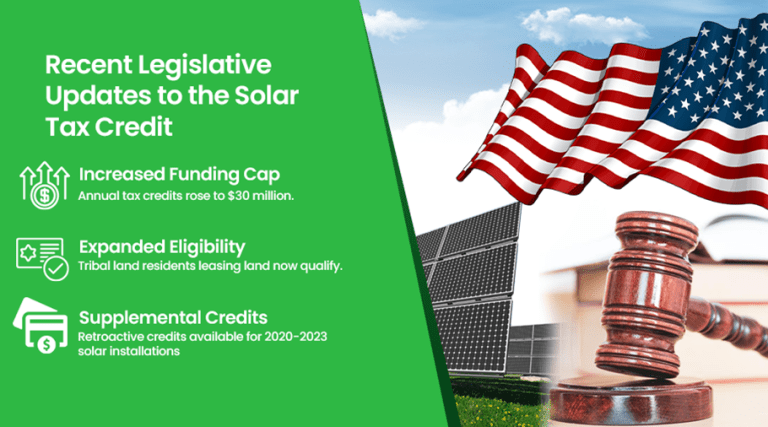

The legislature altered the tax credit in two significant ways during the 2024 legislative session. Firstly, during the tax year of 2024, they have increased the amount from $12 million to $30 million for the installed systems. If you install your PV system in 2024, you can apply under the current rules for this program.

Secondly, the lawmakers made those taxpayers also qualified for the tax credit who live on either tribal lands or have leasehold lands from federally approved tribes. Moreover, the legislature introduced a special credit offer for people who switched to solar during 2020-2023 as they did not qualify for the Market Development Tax Credit.

When are the tax credits available?

EMNRD is currently accepting applications from New Mexicans who have installed their PV systems in 2024. And regarding the special tax credit for past year systems, the organization will make a regulatory process and rules to open the application window once all the laws go into force.

To which tax year does the $30 million credit cap apply?

Starting in 2024, the amount fixed for this program is $30 million for the 2024 tax year. Additionally, EMNRD accepts applications on a first-come, first-served basis. EMNRD has the authority to grant certificates for systems installed during any tax year, up to the statutory limit. That cap is $30 million for the years 2024 and after. Once EMNRD has issued whole or partial credits totaling $30 million for a tax year, all subsequent applications for that year must be rejected by law.

Moreover, taxpayers must send complete applications to EMNRD for eligibility certificates within the year in which they have installed the system.

How will I know if my application is approved or rejected?

If EMNRD approves your application, you will get an eligibility certificate through email. The certificate will outline the taxable year in which you can claim the credit as well as the amount of the tax credit for which you qualify.

In case your application gets reject, you will find the reasons for your request rejection through email. You can fix the issues and re-submit it. But be aware that your application will be placed at the back of the queue. Applications are processed by EMNRD in a first-come, first-served conduct, and the procedure only starts when an application is accurate and complete.

EMNRD has the right to deny an application due to:

Your application is incomplete because you might not complete all the fields on the web form or you are missing a document.

The application has conflicting or missing information; for instance, an address may be typed incorrectly or may not match the address on the permit. For any other query, you can visit the webpage.

In conclusion, the New Solar Market Development Tax Credit offers a great opportunity to the New Mexicans who switch to clean power. Whether you want to reduce your high bills or grid resilience, solar incentives in New Mexico and these tax credits make going solar affordable for you.

SolarSME is a local solar installer near you. Get a Free Quote and take advantage of financial solar incentives in New Mexico.

Related Articles:

Community solar is revolutionizing the shift to solar power. These programs allow people to utilize clean power from solar farms without any upfront cost or solar installation expenses. Explore which states are offering these programs.

Every year, more people choose solar panels for their homes and businesses. Homeowners can benefit financially from solar energy in most cases, however state-by-state variations in this regard can be significant. Explore the best states for solar installation!

The “Federal Solar Tax Credit” is one of the most valuable federal incentives that helps you to cut your PV system cost by 30%. However, it is only available till December 31, 2025. So, now is the best time to switch solar with low installation cost. Explore more!