In today’s rapidly evolving world, the conversation about sustainability and environmental consciousness has taken center stage. We are witnessing a global shift towards cleaner, greener solar energy sources to combat climate change and reduce our dependence on fossil fuels. One of the key mechanisms driving this transition is Renewable Energy Credits (RECs)

In this article, we will explore what RECs are, how they work, and their significance in the journey toward a more sustainable future.

What are Renewable Energy Credits?

Renewable Energy Credits, often abbreviated as RECs, represent the environmental attributes of renewable energy generation. They are a tradable commodity that certifies the production of a certain amount of electricity from renewable sources. In essence, RECs serve as a way to quantify and document the positive environmental impact of generating electricity from renewable resources.

When a renewable energy facility, such as a wind farm or solar array, generates electricity, it simultaneously produces RECs. These credits certify that a specific amount of energy, typically one megawatt-hour (MWh), was generated using renewable sources. RECs provide a valuable tool to track and promote the use of clean energy, even in regions where it might not be immediately accessible.

How Do Renewable Energy Credits Work?

Renewable Energy Credit (REC) works as a vital tool for monitoring and accounting for the contribution of renewable energy sources like solar and wind to the power grid. Since electricity from renewable sources is similar to electricity from fossil fuels, a tracking system is necessary.

This tracking and accounting process is essential because storing electricity in batteries is both challenging and expensive. Consequently, the surplus renewable energy that is not utilized by its producer is usually sent back to the grid for consumption by other customers. The individual responsible for generating renewable electricity, such as a homeowner with solar panels on their roof, then receives REC. They can trade Energy Certificates, although they are typically used as a credit to offset their own electricity consumption.

Why Renewable Energy Certificates(RECs) are Important?

Renewable Energy Certificates (RECs) provide certified evidence to producers and consumers, confirming the origin and utilization of renewable energy from a specific source and its specific buyer. This system offers various advantages:

Transparency:

RECs establish a transparent and reliable record of where renewable energy comes from and how it’s used, preventing deceptive claims and ensuring genuine environmental impact.

Responsibility:

They encourage accountability among producers for their clean energy generation and empower consumers to make informed choices about sustainable energy.

Market Confidence:

The presence of RECs builds trust within the renewable energy market, promoting its expansion and attracting increased investments.

Regulatory Compliance:

RECs streamline compliance with renewable energy regulations, simplifying the process for businesses and governments.

Consumer Choice:

This system enables consumers to actively support renewable energy, even if they lack direct access to it.

Do Renewable Energy Credits Expire?

Renewable Energy Credits (RECs) generally have an expiration date, but the duration varies depending on the specific REC program and jurisdiction. In many cases, RECs have a validity period of one calendar year. After this period, they are no longer valid for compliance.

However, it’s important to note that the expiration of RECs does not negate the environmental benefits of renewable energy. The renewable energy project continues to contribute in reducing greenhouse gas emissions.

It is advisable to consult the relevant REC regulatory authority in your jurisdiction to understand the expiration of renewable energy credits. They will provide accurate information regarding the duration, reporting requirements, and retirement procedures for RECs in your specific region.

Are Renewable Energy Credits Taxable?

The taxes on Renewable Energy Credits (RECs) can vary depending on the jurisdiction and specific tax laws. In numerous countries, the acquisition of RECs may qualify for certain tax incentives or credits. Individuals or businesses that purchase RECs may be able to claim a tax deduction or receive a tax credit for supporting renewable energy projects. These incentives encourage the adoption of renewable energy and reduce greenhouse gas emissions.

On the other hand, the sale of RECs by renewable energy project owners or generators may be subject to taxation. The income from selling RECs is taxable revenue for the project owner or generator. This revenue is typically a part of their overall income and is subject to applicable tax regulations.

It is important to consult with a tax professional or advisor to understand the specific tax policies of RECs in your jurisdiction. They can provide guidance based on local tax laws and regulations and help navigate the potential tax implications of purchasing, selling, or using RECs.

What are the major requirements for Renewable Energy Credits (RECs)?

In some states, there are some policies that mandate power utilities to produce solar energy. These regulations are commonly referred to as “solar carve-outs.” Additionally, many states have established a “Renewable Portfolio Standard” (RPS). This stipulates that power providers must generate a specific amount of renewable energy that increases annually. These RPS requirements play an essential role in the trading of Renewable Energy Certificates (RECs). Power companies may opt to purchase these certificates from homeowners as a means to fulfill their obligation to meet their respective state’s renewable energy targets.

However, the trading of RECs can vary from one state to another. These certificates are recognized by widely, including state and local governments, regional electricity transmission authorities, non-government organizations (NGOs), and trade associations. In addition to solar and wind power, RECs can be issued for various renewable energy sources such as geothermal, hydropower, biofuels, and hydrogen fuel cells.

What are the Differences Between SRCs and RECs?

A renewable energy certificate (REC) is a tradable document that reflects the environmental, social, and other non-electricity-related qualities of renewable energy production. Solar RECs (SRECs) are for each megawatt-hour of electricity generated from solar energy systems.

Renewable Energy Certificates (RECs) and Solar Renewable Energy Certificates (SRECs) are both market-based tools used that promote renewable energy generation and quantify the environmental benefits. However, there are some key differences between RECs and SRECs:

1. scope:

RECs represent the environmental benefits of generating one megawatt-hour (MWh) of renewable energy from any renewable source. SRECs, on the other hand, specifically represent the environmental benefits of generating electricity from solar energy.

2. Focus:

RECs encompass a wider range of renewable energy sources. This makes them perfect for promoting and tracking all types of renewable energy production. SRECs, on the other hand, are specifically for incentivizing and tracking the generation of solar energy. Thus, highlighting the importance of solar power in the renewable energy mix.

3. Issuance:

RECs are issued when one MWh of renewable energy is generated, regardless of the source. SRECs, in contrast, are issued when one MWh of electricity is generated specifically from solar power systems.

4. Compliance Mechanism:

Both RECs and SRECs are compliance mechanisms to meet renewable energy standards or targets set by states or regions. However, while RECs provide a means for utilities or electricity suppliers to meet their renewable energy requirements using any type of renewable energy source, SRECs specifically serve as a compliance instrument for meeting solar energy targets. Both RECs and SRECs are compliance mechanisms to meet renewable energy standards or targets set by states or regions. However, while RECs provide a means for utilities or electricity suppliers to meet their renewable energy requirements using any type of renewable energy source, SRECs specifically serve as a compliance instrument for meeting solar energy targets.

5. Trading Market:

Both RECs and SRECs can be bought and sold on the open market. However, the trading of SRECs deals more with the solar energy sector, while RECs cover a broader range of renewable energy sources. The demand and prices for SRECs depend on specific solar energy targets or incentives in certain regions.

6. Environmental Impact:

Both RECs and SRECs can be bought and sold on the open market. However, the trading of SRECs deals more with the solar energy sector, while RECs cover a broader range of renewable energy sources. The demand and prices for SRECs depend on specific solar energy targets or incentives in certain regions.

While both RECs and SRECs serve as market-based instruments to support and track renewable energy generation, the main differences is in their scope, focus, issuance, compliance mechanisms, trading markets, and environmental impact. RECs encompass a wider range of renewable energy sources, while SRECs specifically target solar energy generation. Understanding these differences helps facilitate the development of renewable energy sources and contributes to a more sustainable energy future.

Can I sell my SRECs?

Yes, you can sell your Solar Renewable Energy Credits (SRECs). SRECs represent the environmental benefits of generating clean energy from your solar panels. They can be sold to utilities and energy providers to meet renewable energy mandates. This provides an additional source of income for solar system owners, making renewable energy more financially rewarding. Selling SRECs not only benefits your wallet but also supports the growth of solar energy, contributing to a greener and more sustainable future.

Benefits of Renewable Energy Credits (RECs)

Renewable Energy Credits (RECs) offer several benefits for promoting and supporting renewable energy generation. Here are some key advantages of RECs:

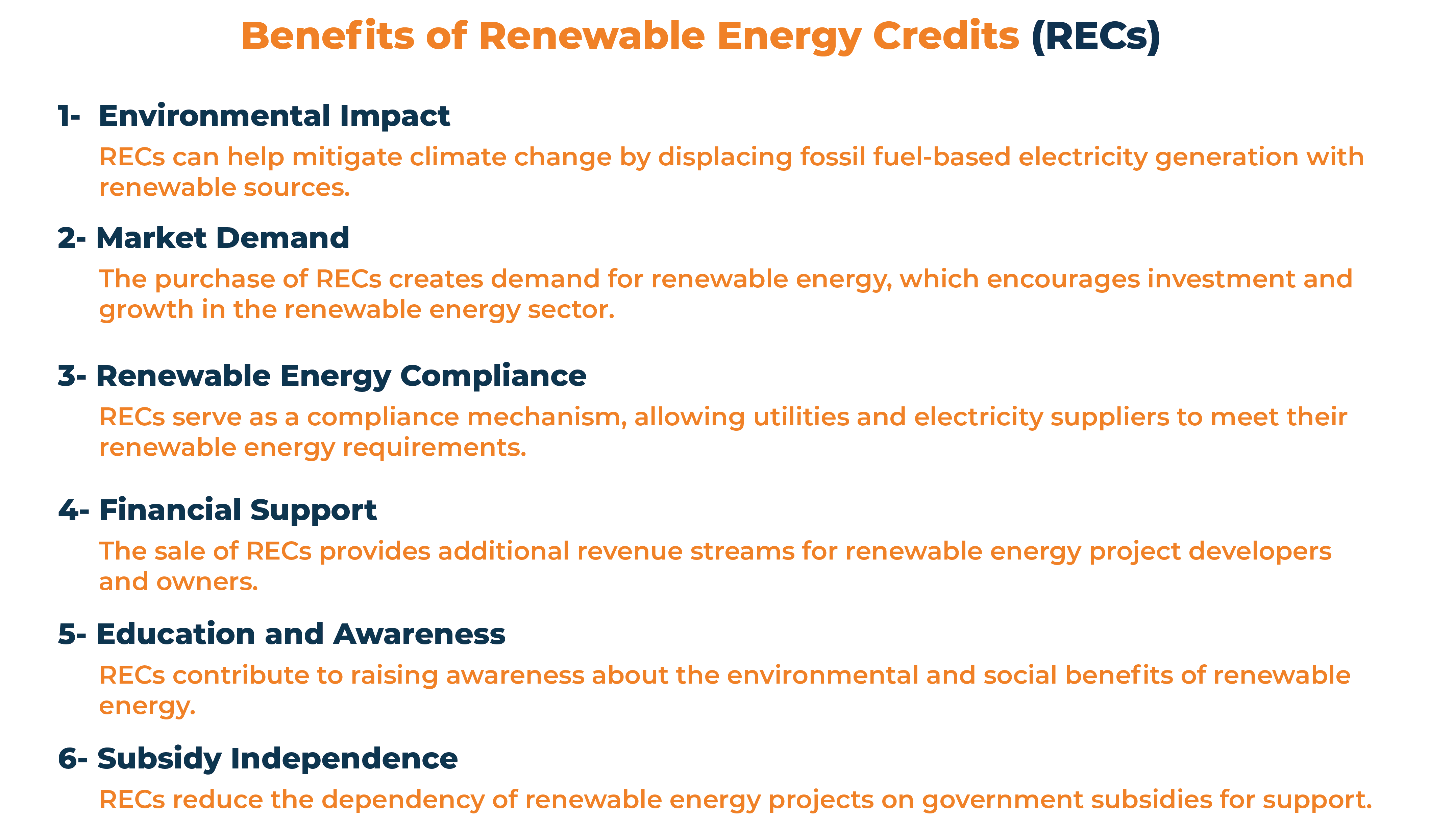

1. Environmental Impact:

RECs provide a market-based mechanism to incentivize the production and consumption of renewable energy. By purchasing RECs, individuals, organizations, or companies can support and contribute to the reduction of greenhouse gas emissions. Moreover, RECs can help mitigate climate change by displacing fossil fuel-based electricity generation with renewable sources.

2. Market Demand:

The purchase of RECs creates demand for renewable energy, which encourages investment and growth in the renewable energy sector. This increased demand can stimulate the development of new renewable energy projects, such as wind farms, solar installations, or biomass facilities.

3. Renewable Energy Compliance:

Many jurisdictions, both at the state and federal levels, have renewable energy standards or targets to promote the adoption of renewable energy. By using RECs, these entities can demonstrate their commitment to renewable energy without directly generating it themselves.

4. Financial Support:

The sale of RECs provides additional revenue streams for renewable energy project developers and owners. This financial support helps offset the higher initial costs of building and operating renewable energy facilities. It enhances the economic viability of renewable energy projects and encourages further investment in the sector.

5. Education and Awareness:

RECs contribute to raising awareness about the environmental and social benefits of renewable energy. By purchasing and using RECs, individuals and organizations can demonstrate their commitment to sustainable practices. It also helps educate the public about the importance of renewable energy generation and its role in combating climate change.

6. Subsidy Independence:

RECs reduce the dependency of renewable energy projects on government subsidies for support. Instead, they establish a system where renewable energy generation is financially viable without continuous subsidies. This makes the renewable energy market more self-sustainable and helps reduce reliance on government funding.

Are renewable energy credits worth it in U.S.?

Renewable Energy Credits (RECs) undeniably hold great value in the United States. They empower individuals and businesses to actively support clean energy while reaping numerous benefits.

By purchasing RECs, you contribute to the reduction of greenhouse gas emissions, helping combat climate change. These credits promote the growth of the renewable energy sector, creating jobs and boosting the economy. Moreover, they facilitate regulatory compliance, aiding businesses and government entities in meeting renewable energy mandates.

RECs also enhance transparency, ensuring that your sustainable energy choices are accountable and trustworthy. In summary, RECs play a crucial role in advancing a greener and more sustainable energy future in the U.S.

In conclusion, renewable energy credits (RECs) provide an accessible avenue for individuals and businesses to support clean energy and reduce their carbon footprint without the complexities of renewable energy installations. By trading in these tradable commodities, we can ensure a cleaner and more sustainable future. Whether through voluntary or compliance commitments, RECs play a vital role in driving the transition to renewable energy sources and advancing our collective environmental goals. Explore the possibilities of RECs and take a step towards a greener world.