- Updated On: September 23, 2025

Top Colorado Solar Incentives

& Rebates Guide 2025

Due to its solar-friendly policies and Colorado solar incentives, the state is considered one of the best solar states in the US. In 2025, residents across the state will continue to benefit from a wide range of solar programs designed to make solar energy more affordable and accessible. From state-level rebates to local utility incentives and federal tax credits, Colorado residents have multiple ways to cut down their upfront installation costs while enjoying long-term energy savings. The state’s strong commitment to renewable energy, paired with its abundant sunshine, creates the perfect opportunity for homeowners to invest in solar. Whether you’re looking to lower your monthly electricity bills, increase your property value, or reduce your carbon footprint, the available Colorado solar incentives and rebates in 2025 provide a practical pathway to achieve those goals. Understanding these programs can help you maximize savings while making the switch to clean, sustainable power.

In this article, we will highlight the best solar incentives in Colorado to help you shift to solar with less solar installation cost and maximum savings.

How much you can save with solar in Colorado?

What are the best Colorado solar incentives for homeowners?

You can boost your return on solar panel investment as a homeowner in Colorado by taking advantage of some great solar incentives like solar panel tax credit, Colorado state taxes, net metering, etc. The best residential solar incentives include:

Residential Clean Energy Credit

The Residential Clean Energy Credit, formerly known as the federal investment tax credit (ITC). It permits homeowners to claim 30% of their total solar system cost as a federal tax credit. You can use this credit to lower your federal income tax burden. Also, you can claim the credit on your annual tax filing for the year of solar installation. But, Trump has announced to end this credit on December 31, 2025.

However, it is important to consider that only the legal solar owner can claim tax credit. Therefore, if you sign a lease or power purchase agreement (PPA), the advantage will go to the solar provider rather than to you. Moreover, vacation homes and other primary and secondary residences qualify for the ITC but rental homes and other investment properties do not.

RENU Loan

The Residential Energy Upgrade (RENU) Loan in Colorado provides solar financing at rates that are comparable to or slightly higher than the market average. Unlike home equity loans, this loan type doesn’t require collateral, and there are no hidden charges.

You can apply for a loan of up to $75,000 with a 20-year repayment period if you own your house and don’t share a heating or cooling system with another house. Furthermore, your credit score and the qualifying credit union will determine your APR. There will be no initial costs, and there won’t be a penalty for early repayment. The loan will have a fixed monthly payment. The Colorado Clean Energy Fund, a non-profit organization associated with the state of Colorado, is supporting it.

Sales and Use Tax Exemption for Renewable Energy Equipment

In July 2006, the state of Colorado approved a sales tax exemption for renewable energy systems, including lithium-ion batteries and heat pumps. Therefore, you will not have to pay the 2.9% state sales tax when you buy solar panels or other qualified technology. A sales tax exemption is provided as an instant savings incentive to Colorado residents who convert to solar power. Let’s say the rooftop solar system costs $16,000. A $464 2.9% sales tax exemption is applied to your purchase.

Property Tax Exemption for Residential Renewable Energy Equipment

For renewable energy installations, Colorado residents are also exempt from property taxes. The increased home value from installing solar panels is not liable for taxation by your municipality. Suppose you are the owner of a $450,000 house in Colorado. Your property tax payment would be $2,700 if you reside in a municipality with a 0.6% rate. You are still liable for $2,700 in property taxes each year if you choose to go solar and the system raises the value of your house to $475,000.

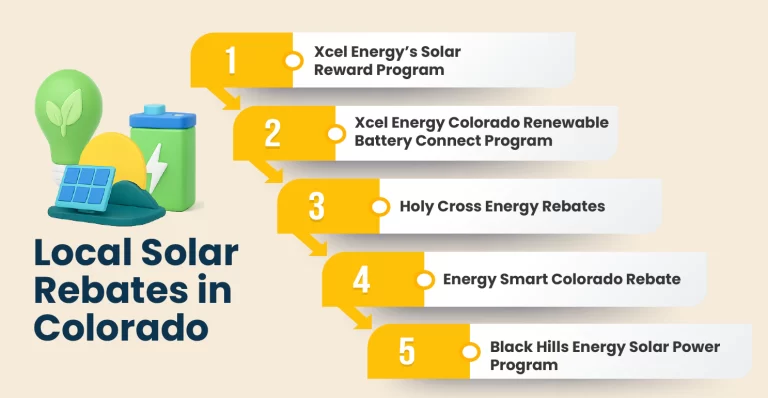

What are the local solar incentives available in Colorado?

Residents in Colorado can take advantage of additional rebate programs by cities and municipalities. A few of the programs are highlighted here.

Xcel Energy Colorado Renewable Battery Connect Program:

For peace of mind, solar batteries are the most sensible option for a backup power system in Colorado. Customers of Xcel Energy who sign up for the Renewable Battery Connect program can get an upfront incentive of up to $5,000 per application, valued at $350 per kW (not kWh, a key distinction). The SolarEdge Home Battery, Tesla Powerwall 2, Tesla Powerwall Plus, and Tesla Powerwall 3 are among the batteries that qualify. For up to 5 years, customers who stay registered in the program can receive $100 a year. As of January 2025, 94% of the allocated funds are still available.Xcel Energy’s Solar Rewards On-Site Solar Program:

Customers who qualify for Xcel Energy’s Solar Rewards On-Site Solar program and reside in a Disproportionately Impacted (DI) community can receive payments of $1,000/kW up to 7 kW. As a fair bargain, you will have to give Xcel 20 years to get your Recs. Within 60 days of your system being authorized to function, you will get a check in the mail if you are eligible.

Holy Cross Energy Rebates:

Holy Cross Energy (HCE) is an electric cooperative that serves over 45,000 customers in Western Colorado. It provides renewable energy incentives for technology such as solar PV systems and energy storage. For systems under 6 kW and systems between 6 and 25 kW, the program pays rebates of $250 per installed kilowatt or $100 per kilowatt, respectively. Moreover, it provides, based upon your enrollment in the Power+ Distribution Flexibility Program, $250 to $500 per kilowatt for solar batteries up to 25 kW in size.

Energy Smart Colorado:

Energy Smart Colorado is a rebate program that includes several energy-saving measures and renewable energy systems. Depending on where they reside, homeowners can qualify for rebates ranging from $500 to $2,500 for purchasing solar equipment and improving their home’s energy efficiency. Energy Smart Colorado provides solar incentives through sub-programs that target certain regions. However, this is not a statewide program. It generally provides rebates in Boulder County, Eagle County, Roaring Fork Valley, and Summit County.Black Hills Energy Solar Power Program:

Black Hills Energy offers a performance-based incentive (PBI) for photovoltaic (PV) systems of up to 500 kilowatts (kW) capacity. In exchange for a PBI, Black Hills Energy gets renewable energy credits (RECs) connected with PV-generated electricity for a set period. All incentive payments depend upon the availability of funds and a pre-installation site inspection. Black Hills Energy has set participation caps for each tier. The status of funding availability for each tier is published on the website. PV installations must be supervised on-site by a NABCEP-accredited professional to maintain a 3:1 ratio of certified installers to solar installers.Is net metering available in Colorado?

If you connect your solar panel system to the grid, you can take advantage of net metering in Colorado. It is the ultimate incentive for rooftop solar, surpassing even large rebates and tax credits. Depending on your utility company and plan, you will get extra credits in cash at the end of the calendar year or carried forward indefinitely.

Moreover, Crediting rules vary slightly across utility companies. For example, Xcel Energy allows you to choose between dollar-based and kWh-based credits. If you want to convert your energy credits to dollars, they can be carried forward always and applied to your connection fee—the flat monthly amount you pay as an Xcel customer. If you select a kWh-based credit, they will settle any remaining credits at the end of the calendar year and send you a check for a few cents per kWh—known as the “average hourly incremental cost,” which is significantly lower than the retail rate you pay them per kWh. Black Hills Energy only provides kWh-based credits, although their payout rate at the end of the year is higher than Xcel’s.

However, utilities with less than 5,000 customers are not required to provide net metering, whereas municipal or co-op utilities have a 10kW limit on the maximum system size for qualified solar installations.

Are solar panels worth it in Colorado?

Colorado is a sunny state with several solar incentives, including a federal tax credit, property and sales tax exemptions, and net metering programs. You may also be eligible for solar grant programs or rebates based on your area. You can also save money on your solar installation by combining state and federal tax credits. Although it is a popular misperception that snow and cold weather might reduce solar productivity, as long as the sun can reach the panels’ faces, they will operate normally.

Whether you live in Denver, Colorado Springs, Fort Collins, or elsewhere, going solar in Colorado can be beneficial. The top solar companies will ensure that your PV system is suitable for your home’s energy needs, ensuring that your panels generate enough energy to offset your electricity expenses.

So, get a FREE Quote for solar savings and start your journey with a certified solar installer near you.

Related Articles:

With the rise in inflation and frequent power outages, solar with battery backup are popular for reducing energy costs by up to 95%. But, for many people, it is still challenging to manage the significant initial expenses. Learn how solar programs help!

The “Federal Solar Tax Credit” is one of the most valuable federal incentives that helps you to cut your PV system cost by 30%. However, it is only available till December 31, 2025. So, now is the best time to switch solar with low installation cost. Explore more!

Net metering is also known as net energy metering (or NEM). It is a process that allows you to send extra energy generated by their solar panels system to the electrical grid and earn credits. However, the policies vary by state. Learn more about NEM states!