Enjoy Power Independence in

North Carolina with Solar

Take Full Advantage of Residential and

Commercial Solar in the State!

Our Location:

Call Us!

(336) 604-6621

North Carolina, from its peaceful seashore to the breathtaking Blue Ridge Mountains, has quickly become a leader in renewable energy. The Solar Energy Industries Association (SEIA) recognized it as the 4th largest state for installed solar with more than 9.3 gigawatts of solar installed by the end of 2023. With a strong solar industry and good incentives, the state continues to lead the way in the southeast to a cleaner, more sustainable future.

Solar Energy Trends in North Carolina

North Carolina Solar Incentives and Rebates for Homeowners

01. State Property Tax Exemption

02. Duke Energy Solar Rebate Program

Duke Energy serves several states, but only North Carolina is eligible for the Duke Energy solar rebate program. Duke’s state customers, whether nonprofit, commercial, or residential, can benefit from this rebate. A residential homeowner will receive a rebate of 40 cents per watt for a 5 kW solar system, which equates to savings of $2,000 on average. Commercial customers are eligible for a rebate of 30 cents per watt. Funds are limited annually and offered on a first-come, first-served basis.

03. Piedmont Electric Member Cooperative Renewable And Solar Energy Loan Program

Piedmont Electric Cooperative offers incentive programs to assist business and residential owners in switching to green energy. The company offers its members a solar energy financing program to help with the cost of buying and installing solar panels and water heaters. Authorized customers can borrow up to $15,000 at a fixed 5% interest rate for 7 years. Take advantage of such solar incentives before they expire.

04. Federal Solar Tax Credit

To encourage homeowners across the country to convert to solar energy, the federal government offers the Solar Investment Tax Credit (ITC). Citizens can receive a federal tax credit equal to 30% of the entire cost of their solar systems.

This credit is only redeemable once per installation. It applies to labor, sales tax, batteries, extra equipment, and solar panels. One of the key benefits of this incentive is that the taxpayer owes less in taxes than the credit amount for the installed solar system, the remaining credit rolls over for a maximum of five years until the full 30% credit on the system is realized.

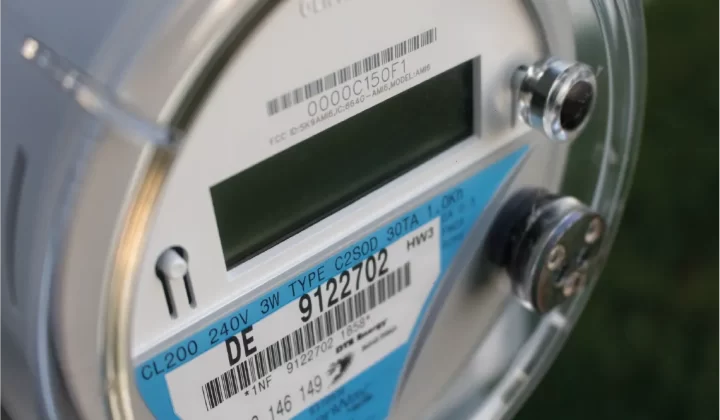

05. North Carolina Net Metering

Under net metering in North Carolina, any excess energy your solar system produces is sent to the electric grid and you’re credited for the power the utility takes from you at the avoided cost rate, as of October 2023. In North Carolina, the scheme is called net energy generation. To measure the two-way flow of electricity, the utility will install a bi-directional meter on your home. After that, you will receive a monthly bill that details how much electricity you consumed and how much was sent to the electrical grid and you are being credited for. The program helps speed the return on investment of purchasing a solar system by further lowering your electricity bills compared to what they were before going solar.

Incentives and Rebates for Businesses in North Carolina

North Carolina provides a variety of incentives and rebates to businesses investing in solar energy, some of which also apply to homeowners as mentioned above. These incentives aim to promote environmental sustainability, job growth, and economic development. Among the major benefits that North Carolina businesses can take advantage of are:

Low-Interest Loans for Rural Solar Panel Installation

The U.S. Department of Agriculture provides support and guaranteed loan financing to small rural businesses and agricultural producers. The installation or upgrade of renewable energy installations is covered under the loan. Small companies and farmers in North Carolina are eligible to apply for these loans.

Solar SME Installation Services in North Carolina

North Carolina continues to lead the solar revolution in the southeast and offers several solar incentives and rebates to help both businesses and homeowners switch to solar power. Whether you are a business looking to cut your operational costs or a homeowner looking to lower your energy bills, Solar SME offers affordable Residential & Commercial solar solutions to meet your energy goals.

Explore your Solar Savings in North Carolina!

Frequently Asked Questions

Duke Energy’s PowerPair offers incentives to customers who wish to combine the security and reliability of backup battery storage with the cost savings of solar electricity. The following one-time incentives may be available to qualifying PowerPair installations: Installing solar panels up to 10 kW-AC costs $0.36/watt-AC.

Solar SME is one of the best solar power installers in North Carolina. We offer professional solar panel installation, low prices, and high-quality guarantees. SolarSME specializes in designing and installing solar energy systems for homeowners and businesses and offering all the resources needed to take advantage of stat-based incentives for utilizing renewable energy.