- Published On:

Solar Payback Period Without Federal Tax Credit: Is it Still Worth it to Go Solar?

On the 4th of July, President Trump formally signed the “Big Beautiful Bill”. He made it official that the 30% federal solar tax credit will expire on January 1, 2026. Eliminating the federal solar tax credit put a ripple effect throughout the solar energy industry. The Investment Tax Credit (ITC) has made solar systems more cost-effective for homeowners, who get to see their return on investment earlier. But no more, due to the recent rescission by President Trump’s “Big Beautiful Bill.” Homeowners now have to cover the entire expense of solar installations. Everyone is asking, what will the solar payback period be without the tax credit? The removal of the ITC undoubtedly raises the cost threshold. However, rising rates of electricity and increasingly frequent long power outages remain the biggest reasons for homeowners and businesses to invest in solar.

Federal Solar Tax Credit: A Brief History

The investment tax credit has been a leading reason by subsidizing 30% of the cost of systems since 2006. With rising inflation, sky-high electric bills, and extended outages, the majority of U.S. citizens are switching to solar energy with this tax credit. Section 25D of the tax code gave residential solar customers a 30% federal tax credit of their system cost. Also, Section 48E did the same for commercial and utility projects. Those incentives have put the solar industry on a fast track, lowering installation costs and spreading clean energy throughout the nation.

But for years, conservative lawmakers and lobbyists had battled the credits for the fossil fuel industry , complaining they were warping the free market and providing an unfair subsidy to clean energy at the expense of traditional sources like coal, oil, and natural gas.

In the Trump presidency, efforts to kill the credits went a different way. Previous efforts at removing the ITC had failed because solar had been so popular and created jobs. But after the GOP regained Congress in 2024, that was no longer true. The July 4, 2025, signing into law of the “Big Beautiful Bill” was the deadline for repealing Sections 25D and 48E by the end of the year 2025.

While the supporters have the belief that the industry has matured enough to survive without solar incentives and tax credits, the opponents believe that eliminating them would decelerate the development of solar and increase the payback period for solar, making it less affordable even for middle-class homeowners, and decrease the initiatives to achieve clean energy goals across the nation.

How will the elimination of the solar tax credit impact the solar industry?

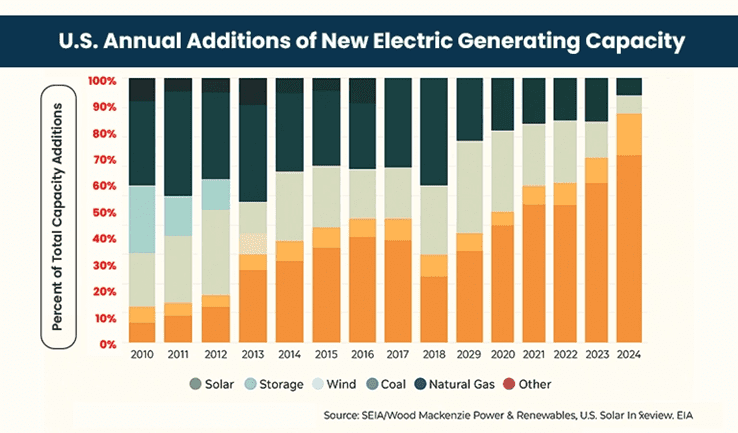

According to SEIA and Wood Mackenzie’s Solar Market Insight Report, solar and battery storage will account for about 84% of newly added generating capacity in the U.S. in 2025. This percentage has been rising gradually over the past 15 years. Furthermore, on a much broader scale, 75% of new U.S. generators that are currently under manufacturing will be powered by solar and energy storage.

The unpredictability of these tax credits, along with high tariffs and loan rates, has already led to industry bankruptcies and layoffs.

What is the expected solar payback period without a federal tax credit?

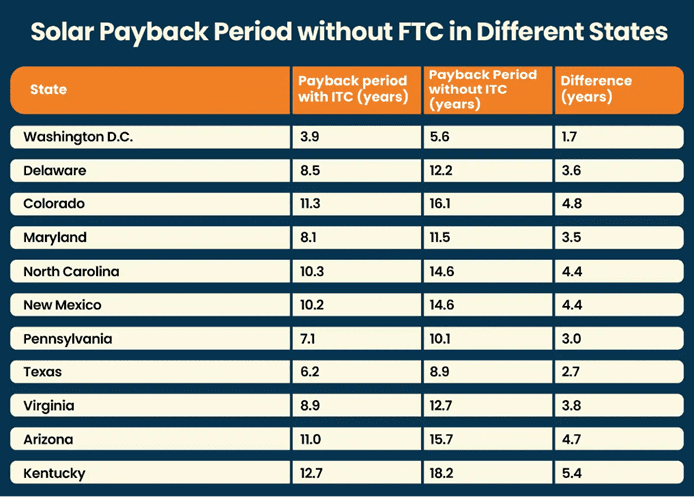

The time solar system owners take to recover their solar investment is termed as the payback period of solar panels. Lower payback period means a greater return on investment. Nevertheless, an owner in the USA can expect that the solar energy system will pay for itself in 9-12 years. After this, the energy your system produces will be considered free, and you can save for the rest of its life. Solar panels are guaranteed to last for at least 25 years. New solar panels these days, however, are made to last 30 years due to advancements in technology. A good solar payback time would thus be less than half that of the lifetime of the panel.

The 30% investment tax credit is the pillar of residential solar. Solar benefits aren’t specific for rich homeowners, according to a New Lawrence Berkeley National Laboratory report. 44% of the households that installed solar in 2023 have incomes below $100,000 annually, and most (30.5%) make between $50,000 and $100,000. The expiration date will impact working families, who count on the tax credit to allow them to afford solar because electricity rates continue to rise. Without the solar tax credit, the average American will have to pay 30% more for the cost of installing solar panels, which would yield about a 43% longer payback period.

What are the other major impacts of eliminating the federal tax credit on the residential solar sector?

Besides a longer solar payback period, there will also be some major impacts of tax credit elimination by the end of the year. This includes:

Less Savings on Upfront Solar Cost:

Installing solar panels allows homeowners to offset their installation expense by 30% with a federal tax credit, which can save them an average of $9,000. The expiration will lead to high solar upfront costs, and solar will become less affordable for middle-class families.

New Restrictions on Solar Leases and PPAs:

Another way for homeowners to save money on solar costs is through third-party financing. With little to no upfront costs, these agreements can lower monthly electricity bills; however, solar businesses, not homeowners, receive the tax benefits.

The 30% tax credit will still be available to businesses that sell leases and PPAs, but there are still limitations. By December 31, 2027, projects that start more than a year after the bill’s passing must be finished. Additionally, systems must have 40% domestic scope by 2026 and 60% by 2030 to be eligible for the tax credits; this requirement may have an impact on project availability and pricing.

High Electricity Rates:

The electricity demand is predicted to rise by 130% by 2030 due to huge demand being driven by AI data centers. Utilities are increasing grid infrastructure and electricity output to fulfill this demand, which directly affects homeowners by raising energy rates.

Also, rooftop solar supports utilities in grid infrastructure upgrades without large investments. It is the quickest method of adding more electricity to the grid. However, Congress just eliminated the primary incentive for this grid-stabilizing technology.

Job Losses:

As per the SEIA, the expiration of the tax credit will result in the loss of 62,000 American jobs by the end of this year 2025 and nearly 200,000 next year. This is because the residential solar industry supports over 100,000 jobs. Also, a huge number of solar installers work for small local businesses.

In conclusion, eliminating the federal solar tax credit may lead to longer payback and higher upfront costs. But installing solar will still be worth it. With the increasing demand, high utility rates, and long power outages, solar with battery storage is the best solution for major energy crises. However, it is important to make informed decisions.

If you are planning to go solar, only 5 months are left for 30% solar tax credit. On the other hand, more people are rushing to solar installers to grab it, so you need to act now. Solar SME is a trusted local solar installer near you with tailored solar and backup solutions for your energy needs. Hurry up! The clock is ticking… Get a FREE Quote with our smart solar calculator and book your solar installation before it costs you much more.

Related Articles:

With the rise in inflation and frequent power outages, solar with battery backup are popular for reducing energy costs by up to 95%. But, for many people, it is still challenging to manage the significant initial expenses. Learn how solar programs help!

Over the past decade, the U.S. solar industry has witnessed rapid growth as solar power has become the popular choice of homeowners and businesses.

The “Federal Solar Tax Credit” is one of the most valuable federal incentives that helps you to cut your PV system cost by 30%. However, it is only available till December 31, 2025. So, now is the best time to switch solar with low installation cost. Explore more!