Delaware: Embracing Solar

Energy for a Sustainable Future

Illuminating Delaware Homes and Enriching

Lives with Solar Energy in Delaware

Solar Incentives for Homeowners in Delaware

Federal Solar Tax Credit

As in most states, the federal Investment Tax Credit (ITC) is the biggest. Currently, it covers 30% of the cost of systems installed through 2032. To offset their energy bills, the average Delaware resident needs a 9.5 kW solar energy system. If the system costs $29,070, the average federal solar investment tax credit is $8,721. After installing solar the homeowner’s income tax bill is credited with that sum, making the total cost about $20,349.

Delaware Net Metering

Delawareans who upgrade to renewable energy sources for their homes can benefit from net metering. Under the program, the utility records how much electricity the solar installation produces and sends to the grid. It also measures how much electricity the home draws from the grid. If the system produces more energy for the grid than the home consumes, it is credited toward the next electric bill.

Local Solar Incentives for Homeowners in Delaware

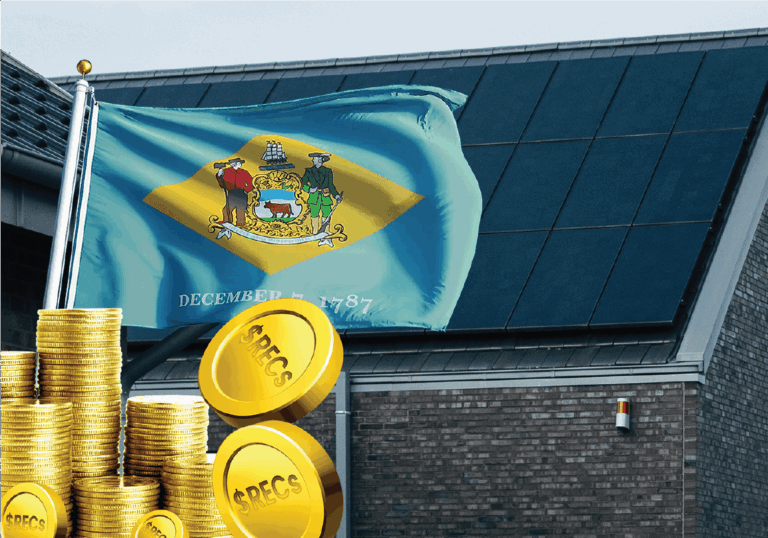

Solar Renewable Energy Credits in Delaware

Solar Renewable Energy Credits (SRECs) are available to Delaware homeowners who install solar panels. A homeowner receives one SREC for each megawatt-hour (1,000 kilowatt hours) produced by their solar system. They can then resell it to utilities and other programs. The sale helps fulfill the requirements of the renewable portfolio standards set by the state. Prices change according to supply and demand.

Delaware Electric Cooperative Green Energy Program

Customers of Delaware Electric Cooperative (DEC) will receive a solar rebate of $0.50 for each watt up to 5 kW and $0.20 back for each watt beyond that. The program has a cap of $2,000 per installation. Given the typical system size in Delaware most consumers should be able to claim the entire $2,000 rebate.

Incentives for Commercial Solar Delaware

Delaware Green Energy Program

For businesses looking to make the switch to solar, the Delaware Green Energy Program offers a range of incentives. Through this program, commercial and industrial entities can access grants and rebates to support the installation of solar PV systems.

Commercial Property Assessed Clean Energy (C-PACE)

Delaware businesses can take advantage of the state’s Commercial Property Assessed Clean Energy (C-PACE) program. Additionally, these commercial solar programs facilitate low-cost, long-term financing for energy efficiency and renewable energy projects through property tax liens. This allows businesses to install solar systems with minimal upfront costs. Instead, they pay for the improvements over time through a special property tax assessment.

Delaware Division of Small Business EDGE Grants

The Delaware Division of Small Business EDGE Grant supports small businesses in the state with financial assistance for qualifying projects. Moreover, these include energy efficiency and renewable energy projects. Funds are limited and the program grants are available on a first-come, first-served basis.

Solar SME Installation Services in Delaware

Whether you’re a homeowner looking to reduce your carbon footprint or a business aiming to enhance sustainability, Solar SME, your local solar provider in Delaware can help. Delaware has several incentives and rebates to help reduce the costs of those investments.

Explore your Solar Savings in Delaware!

Frequently Asked Questions

For your home solar installation, the grant pays out $700 per kilowatt (kW), up to a maximum of $6,000! For instance, you may expect a $3,600 rebate on a typical 6kW installation. Up to a maximum of $3,500, the DEMEC green energy program rebate pays out $1,000 per kW.

By 2026, the state’s renewable portfolio standard (RPS) aims to have 25% of its electricity generated by renewable sources, with solar accounting for 3.5% of the total.

In most places, including Delaware, solar panels are worthwhile. How quickly you break even on your investment in comparison to other regions of the United States depends on a number of factors, including as the cost of power, subsidies, climate, and the angle at which the sun strikes your roof.

Yes, Delaware has SRECs – this is Solar Renewable Energy Certificates. This type of SRECs is ‘gross’ meaning that homeowners and businesses are paid SRECs for every MWh of power that is produced by their solar installations. These can then be sold to utilities as a way adapting with Delaware’s Renewable Portfolio Standards which gives a good reason to embrace the use of solar energy.

SolarSME is one of the best local solar companies in Delaware offering affordable residential and commercial solar solutions with flexible financing options. If you are looking solar power installers near me, SolarSME is here to make your solar journey convenient.