- Updated On: September 17, 2025

Commercial Solar Installation in Texas: Exploring Cost-Saving Opportunities

Power reliability is becoming one of the biggest challenges for Texas nowadays. The business sector is also facing high energy costs and incurring millions of dollars in losses due to the aging and unstable power grid. Also, due to climate change, long power outages are now a new normal. This leads to operational disruption, lower productivity, and low operational efficiency. For instance, in Hurricane Beryl, over 2 million homes and businesses were left without power. The economic damage was estimated at approximately $5 billion. Besides, for companies like manufacturing companies or data centers, which require a continuous supply of electricity for smooth operations, the shortage of electricity is not only unfavorable but also a danger to the effectiveness and profitability of their operations.

Switching to commercial solar power in Texas is a practical solution for businesses to fight back against all the electricity challenges. With commercial solar installations, businesses can generate power with unlimited and free sunlight. It minimizes grid reliance, saves on increasing utility rates, and maximizes their profits. Beyond that, using solar power with a good battery backup system ensures no power disruption during outages. Hence, enabling smooth workflow and increased operational resiliency. Also, the commercial solar incentives offered in Texas and tax credits are another compelling reason to switch to low-cost clean power solutions.

We will explore the top reasons and benefits of commercial solar installation in Texas in this article. Also, we will highlight the top TX solar incentives and rebates available for business owners.

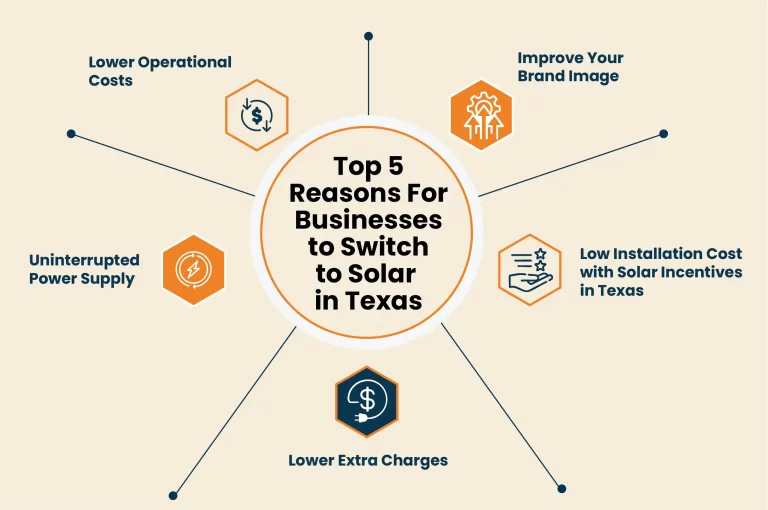

What are the top benefits of commercial solar installation in Texas?

Commercial solar installations provide all the benefits that residential solar installations do, only at a much larger scale. Switching your business to solar is a smart decision in Texas. From financial savings to power during blackouts and environmental benefits, the advantages are clear. Here are some top advantages of commercial solar in Texas:

1- Lower Operational Costs

Utility bills are among the highest expenses for any organization. 35% of small businesses list energy costs as one of their top business expenses, according to the National Federation of Independence’s (NFIB) most recent Energy Consumption survey. Also, utilities are looking for new ways to increase revenue from their current clients, who are mainly business and industrial electricity consumers, as the cost of electricity and natural gas continues to grow nationwide. The U.S. Energy Information Administration (EIA) reports that the average commercial building (small-to-mid-sized firms) spent $650.04 on electricity in Texas. This adds up to $7,800 in operational costs over a year. Your company will spend roughly $156,010 on energy over the course of 20 years. On the other hand, Texas is the 4th sunniest state and is ideal for solar to power commercial ventures. Powering your business with solar costs 60-85% less than powering it with electricity from the grid. Beyond the direct financial benefits, installing solar panels can also help your business protect itself against electricity price volatility and inflation. Furthermore, commercial solar installation in Texas provides a great return on investment.

2- Uninterrupted Power Supply

Like other states, Texas businesses are also facing power outage challenges due to bad weather conditions and the Texas Electric Grid’s old infrastructure. By installing commercial solar panels, you can generate your own power for smooth operations without any interruptions. Also, if you add a backup storage solution like Tesla Powerwall 3, it reduces the dependence on the grid. You can store excess power and utilize it during the night or when solar panels are not producing much power, like on cloudy days. Uninterrupted power supply means efficient operations, hence timely goal achievement and more profits for your organization.

3- Lower Extra Charges

Businesses typically pay higher electricity tariffs than do homeowners. Time-of-use (TOU) rates represent the true cost of electricity depending on supply and demand. This is a more complex electricity pricing structure that utilities generally employ to businesses. Depending on the weather and level of use, the cost of producing energy changes from hour to hour, day to day, and season to season. Similarly, many utility companies charged demand rates to businesses that are different from the peak hours charges during a month. So, if you install a commercial solar system in Texas, the potential savings will be much more than what you are currently paying to the utilities. Especially with storage, you can shave peak demand, leading to substantial bill savings if your organization is on a demand charge utility rate.

4- Low Installation Cost with Solar Incentives in Texas

The upfront cost of commercial solar installation may seem much higher, but there are several best solar incentives and rebates available in Texas to help you minimize your system cost by up to 50%. Also, many utility companies offer solar buyback plans in TX through which you can earn credits by sending excess power back to the grid. Moreover, if you are not able to buy a solar system with cash, you can consider commercial solar financing options like solar loans, lease programs, or PPA.

5- Improve Your Brand Image

Businesses committed to sustainability attract a lot of existing and potential clients. A study on environmental, social, and governance (ESG) issues found that 83% of consumers think businesses “should be actively shaping ESG best practices.” Furthermore, according to research by NielsenIQ and McKinsey & Company, customers are willing to pay more for sustainable goods. By taking your business to clean solar power, you will lower your company’s carbon footprint, helping you build a sustainable brand. It will help you gain positive media attention and raise brand awareness among your customers.

What are the best commercial solar incentives in Texas?

Here are some of the best solar incentives available today for businesses to go solar with affordable solar systems:

Federal Investment Tax Credit (ITC):

The biggest financial incentive for all solar buyers is the federal tax credit. The ITC offers businesses a tax credit equal to 30% of the upfront cost of a solar system until 2025. After that, this best solar incentive will expire. Since the ITC is a credit rather than a deduction, it lowers your tax liability by 30%. You may also be eligible for additional tax credits other than the 30% if your system is installed as part of an economic benefit system or low-income residential building project, contains U.S.-made equipment, etc.

Production Tax Credit (PTC):

The production tax credit (PTC), previously exclusive to wind projects, is now an option for commercial solar systems under the IRA. Instead of paying system owners the upfront cost of the system, the PTC bases its compensation on production (on a $/kWh basis). This credit is particularly appealing to owners who produce lots of energy but are relatively inexpensive to build on a cost-per-watt basis, i.e., very large commercial facilities. However, inflation impacts the PTC value.

Texas PACE Financing:

The Texas PACE Financing is an important solar incentive for Texas business owners. PACE stands for Property Assessed Clean Energy (PACE) financing. It’s a program that offers low-cost, long-term financing for water and energy-saving upgrades. TX-PACE was enabled by Senate Bill 385 (83R), which was passed by the Legislature in 2013. It permits counties and municipalities to collaborate with financial institutions and property owners to pursue improvements using a lien against the property to secure low-interest rate financing that’s repaid over 10 to 20 years.

In other words, PACE secures private funding for a duration equal to the expected lifespan of the upgrades, saving more money on utilities than it takes to pay back. If you sell the business, the PACE loan payback requirement shifts with the property to the new owner. So, you can sell out your property without worrying that you will overinvest.

Modified Accelerated Cost Recovery System (MACRS):

Through the depreciation benefit known as MACRS, you can recover the depreciated value of your solar installation over a five-year period and reduce your taxable earnings. Combining MACRS with the solar tax credit can result in tax benefits equal to roughly 70% of the commercial system’s purchase price.

Bonus Depreciation:

Bonus Depreciation is a depreciation-based tax incentive for companies to switch to commercial solar. It is very similar to MACRS. The main distinction between Bonus Depreciation and MACRS is that the former allows you to allocate the depreciation advantage over five years. Bonus Depreciation, on the other hand, lets you get the full benefits of your investment within the first year. Your tax rate will determine how much you save. Nevertheless, depending on the system’s size and cost, bonus depreciation combined with the ITC typically offers incentives equal to roughly 50% of the system’s cost. However, it is a time-sensitive incentive and will disappear in 2027.

State Solar Property Tax Exemption:

In Texas, a property tax exemption is available for solar energy systems on commercial buildings. This protects the business from paying for the increased value a solar system adds to the building in its property tax assessments. With the exemption, the business property is taxed based on the property value before the system is added. In this way, businesses will continue to save on their property taxes throughout the life of the solar installation.

In conclusion, as energy crises surge in the United States, considering commercial solar installation in Texas with the best solar incentives for businesses is well worth it. With a right-sized solar energy system installed by a professional solar installation company like Solar SME, you can ensure an uninterrupted power supply, lower operational costs, and maximize future savings for your business. Get a FREE Quote with our smart solar calculator for estimating your business solar savings!

Related Articles:

With the rise in inflation and frequent power outages, solar with battery backup are popular for reducing energy costs by up to 95%. But, for many people, it is still challenging to manage the significant initial expenses. Learn how solar programs help!

For business owners, every minute of outage means loss and delay, making energy independence a major concern. That is where commercial solar comes in as a solution. This guide will help you understand the factors impacting cost and tips for less expenses.

As businesses seek reliable, cost-effective energy solutions, commercial solar emerges as a powerful alternative. Beyond reducing monthly utility bills, solar offers energy independence, protection from rising rates etc. Learn about top reasons and benefits!