- Updated On: Sep 30, 2024

Insurance on Solar Panels:

Protecting your Solar Investment

Solar insurance gives homeowners extra assurance that the system they invested in will produce energy as expected. Here’s a guide to everything else it does. Going solar is a worthy investment, but it is an investment, and you want to get as much return out of it as possible. That means it has to perform to—or exceed—expectations. The important thing you don’t want is an unexpected event that damages your solar system, leaving you with a hefty repair bill or having to replace it entirely. This is where solar insurance comes into play. It offers peace of mind and assurances that if anything goes wrong with the system it will be fixed.

What is solar system insurance?

Solar panel insurance is an insurance policy that ensures any damage to your solar panels or other equipment is covered and it will be fixed or replaced, just like getting an insurance plan on a new car or TV. Buying an insurance package to cover your solar system will help you avoid the total cost of repairing or replacing your solar panels.

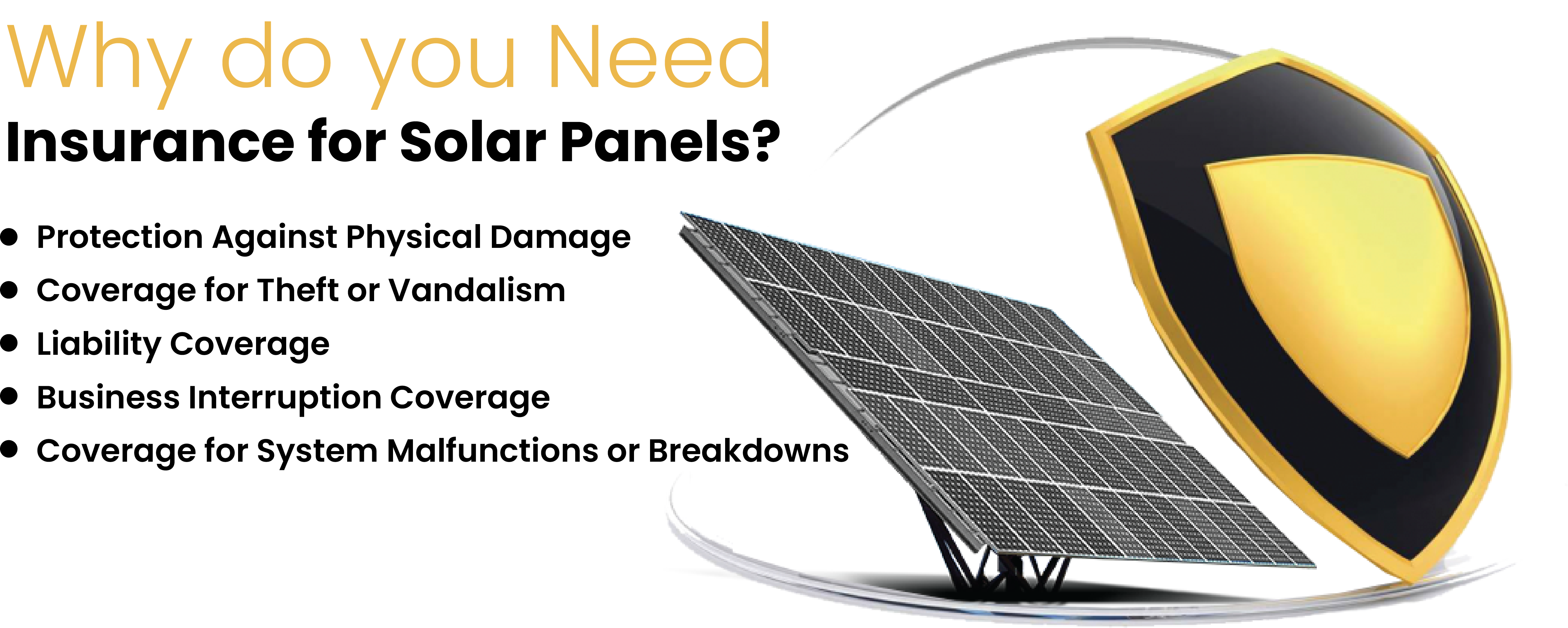

Why do you need insurance for solar panels?

There are several reasons why you should consider getting solar insurance. The first and most obvious reason for obtaining insurance on solar panels is to protect against physical damage. While solar panels and systems are made to withstand a lot of abuse, they can still suffer damage. This can include damage from natural disasters, such as hurricanes, earthquakes, and hail storms. They are also sometimes subject to theft, vandalism, or damage by a fire.

The insurance makes sure that the replacement and repair of your solar panel happens quickly. If your solar panel sustains any sort of damage, you want to get the back up and operating as soon as possible so that you can continue to generate electricity and save money on your energy bill.

Are solar panels covered by home insurance?

Yes, most home insurance policies cover solar panels. However, coverage varies based on the provider and policy you have. Some insurers include special coverage for solar panels in their basic homeowner’s policy. Others might need extra policies or riders to cover the system. It’s essential to thoroughly review your home insurance policy and speak with your insurance company to make sure your solar panels are sufficiently covered from future losses or damages.

Do solar panels affect home insurance?

Honestly, it depends upon your insurance company and your homeowner’s insurance rules. It is best to increase your insurance coverage to remain on the safe side. Usually, the insurance coverage you have before installing solar panels will not cover the cost of repair or repayment alone. Most residential solar panel systems cost between $10,000 and $20,000 before incentives that help bring the cost down. That’s a large investment on your property. To make sure that the homeowner insurance policy protects these solar panels, you should consider increasing the coverage limit of your insurance policy or purchasing a separate policy to cover your solar system.

How much does solar insurance cost?

The annual cost of solar insurance falls within the range of $100 to $1,000. However, it varies based on the insurer, your coverage options, property location, solar system size, and coverage limits. Certain insurance providers may offer discounts to homeowners with solar panels. Additionally, homeowners might qualify for tax credits or rebates related to their solar panel installation, helping to mitigate the expense of insurance coverage.

Insurance for Ground Mounted Solar Systems:

While homeowner’s insurance is likely to cover rooftop solar to some extent, it doesn’t usually cover ground-mounted installations, like solar carports, or in a yard. For these you’ll definitely want to consider an extra solar insurance policy.

Insurance Policy on Leased Solar Panels:

Leased solar panels are owned by a third party. If you are leasing solar panels or buying them on the power purchase agreement, you do not have to worry about the hike in your insurance premiums or buying extra homeowner insurance. Third-party companies, which are usually solar panel providers, will cover the insurance since they technically own the systems. Your lease provider can confirm whether they offer any insurance on damages to solar panels or your home during the installation process. It is always better to clarify these types of details with the lease provider beforehand.

Leased solar panels are a better option for those who want to go solar but do not have the upfront money to do so. Many solar company providers give you the option to lease their solar panels with little to no upfront cost.

Solar Insurance on Commercial Buildings:

Investing in solar panels for a company is a substantial financial commitment and while it will help the company control its energy costs and be more sustainable, the system could get damaged. While it’s unlikely, a solar installation could be vandalized, stolen, or damaged by a storm or fire. To mitigate potential losses, it’s essential to understand coverage and insurance options for solar panels on commercial properties.

Commercial Property Insurance:

Commercial property insurance not only covers the building itself but also extends to solar panels. In the event of damage from fire, theft, or vandalism, this insurance can assist in covering the repair or replacement costs of solar panels. However, it’s crucial to understand the coverage offered under the policy as it might be limited. Such policies may only cover damage from about $2,500 to $10,000. Here are how some commercial property insurance policies can cover solar. Beyond that, business owners can purchase specialized solar insurance.

Business Owner’s Policy (BOP):

A BOP with commercial property coverage, should insure both the building and other equipment, including solar panels.

Equipment Breakdown Insurance:

Equipment breakdown insurance typically covers electrical and mechanical damage. It can cover the repair or replacement of solar panels, based on the amount covered under the policy.

How do I get solar insurance?

You can obtain solar insurance through providers that offer coverage for solar energy systems. Several insurance companies provide specialized coverage policies and risk strategies to help protect solar energy investments. These plans can also include monitoring and increased warranty protections.

You may also get solar insurance through your current home or commercial insurance company by seeing if they offer an additional policy or rider for solar. They will assess the value of your installation and ask how much you want to insure it for. They will adjust your existing policy’s insured value accordingly and send you an updated invoice.

This process is typically straightforward, with insurance companies streamlining the signup and payment procedures for such additions. You may not need to provide detailed specifics of your solar system, but you should always have those details on hand in case you need to make a claim in the future.

To sum this all up, we can say that solar insurance is an important investment for anyone who has or wants to install solar panels on their property. It offers protection against physical damage, performance losses, ensuring that your investment is protected against any potential risks and uncertainties. By getting solar panel insurance, you can enjoy peace of mind and the assurance that your investment will not go to waste. This will allow you to focus on maximizing the benefits of your solar panels for years to come.

With the growing cost of electricity and uncertainty in global climate patterns, now is the time to take advantage of solar and obtain this valuable coverage. A company like SolarSME will help you understand and evaluate what coverage is best for you.

Related Articles:

Installing a solar energy system is a costly investment, but the good news is that there are several solar financing options to fit your budget and financial goals. Lets explore each financing option and its pros and cons to help you in the decision-making process.

Installing solar panels is a huge investment. For many potential homeowners, the primary motivator to invest in a home solar system is the commitment to long-term savings.

Solar loans are a cost-effective solution for installing solar panels on your home or business. However, many are unsure about their functionality and the benefits they might derive from this type of solar financing.