Solar SME Washington, DC

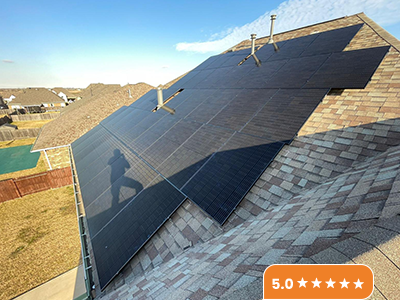

Top-Rated Solar & Battery Installers

Experience energy independence with smart and sustainable power

How much can you save on electric bills with solar in Washington, D.C.?

10 Years

84%

Solar Financing Options in Washington, D.C. by Solar SME

Best Residential Solar Incentives and Rebates in Washington, D.C.

01- Residential Clean Energy Tax Credit

02- Solar Renewable Energy Certificates (SRECs)

03- Solar for All

04- Washington D.C., Solar Tax Exemption

Is net metering available in

Washington, D.C.?

Commercial Solar Installation in Washington, D.C.

Why is it worth it to switch to solar in Washington, D.C.?

The U.S. Energy Information Administration (EIA) expects U.S. residential electricity prices to average 16.8 cents per kilowatt-hour (kWh) in 2025, up 2% from last year. With reduced solar panel costs, rising bad weather conditions, and long power outages, solar continues to deliver major financial benefits in Washington, D.C. Top reasons to switch to solar in DC include:

Low Electric

Bills

Maximum Grid Independence

Flexible Financing Options

Increased Home Value

Earn Energy Credits/SREC Programs

The best way to determine how to maximize your solar savings in Washington, D.C. is to consult with a local solar installer. Solar companies near you can guide you with the best solar solutions and incentives in your area and can help you to get the most out of your solar investment.

Calculate your Solar Savings with Solar SME Smart Solar Calculator NOW!

Step 1:

Property Type

Step 2:

Financing Options

Step 3:

Enter Your Current Electric

Bill & System Preferences

Our Customers are Getting Up to 90% Lower Electric Bills with

Solar SME Tailored

Solar Solutions

City: Washington, DC

System Size: 6.8 kW

Annual Savings: $1,180

City: Washington, DC

System Size: 8.2 kW

Annual Savings: $1,390

City: Washington, DC

System Size: 9.5 kW

Annual Savings: $1,580

City: Washington, DC

System Size: 9.5 kW

Annual Savings: $1,580

City: Washington, DC

System Size: 12.4 kW

Annual Savings: $2,040

City: Washington, DC

System Size: 14.1 kW

Annual Savings: $2,290