Solar SME New Mexico

Reliable Solar Installer You Can Trust

Invest in solar solutions that deliver control, savings, and security

Our Location

(505) 234-1871

With about 280 sunny days annually, New Mexico is one of the states with the most solar exposure due to its expansive landscapes and clear skies. It is an ideal location for solar energy ventures due to its abundant sunshine. Also, the state actively encourages the use of solar. To help residents save money on their solar energy systems, the state offers a variety of solar incentives and rebates. Solar SME is a top-rated solar installation company in New Mexico that provides professional solar installation, premium equipment, and reliable battery storage solutions customized for homes and businesses. If you are looking for a trusted solar installer in New Mexico, Solar SME is the best option. We offer tailored solar systems designed to deliver long-term savings, energy independence, and a strong return on investment.

How much can you save on electric bills with solar in New Mexico?

The average New Mexico energy consumer uses 942.00 kWh per month and 11304 kWh annually, based on the average electricity costs of 16 ¢/kilowatt-hour (kWh). A typical New Mexico resident spends about $150 per month on electricity. You can anticipate paying $54,100 in electricity bills over the next 25 years. In New Mexico, installing a solar system will typically pay for itself in 10.22 years. The average New Mexico power consumer will require a 6.0-kilowatt (kW) solar panel system to offset 100% of their annual electricity consumption based on the state’s sunshine intensity and duration. Additionally, adding a battery storage solution further enhances grid independence, and you can even earn from excess power generation.

25-year Savings

$62,880

10 Years

84%

Solar Financing Options in New Mexico by Solar SME

Solar installation is a worthy investment; however, it may cost you more to own your solar panel system. If you are unable to own due to any reason, like you are a renter or do not have enough cash in hand, some flexible solar financing options are available for you:

The best option for maximizing the benefits of a solar energy system is ownership. When you own, you are eligible for all the local and federal solar incentives to offset your solar installation cost. Also, there is no loan paperwork, no interest calculations, no increasing lease payments, and no monthly payments after installation. Additionally, your home value will also go up by 7%-14%.

Solar loans are the best option for you if you want to take full advantage of a solar PV system but do not have enough investment to buy one. With a solar loan program, you will make fixed monthly payments for 5-25 years while benefiting from instant energy savings. It provides cost predictability, unlike utility bills or lease escalators, which rise over time. The best part is that the lending rate is down to 4.0% - 4.25%. Furthermore, you can avail all solar incentives and solar tax credit in New Mexico with loan financing. A local solar installation company, like Solar SME, can help you to go solar with 0% APR option.

With the 30% tax credit expiring and high upfront costs, solar lease/PPA financing is becoming increasingly popular in the U.S. for reducing high electricity bills and minimizing grid reliance. Third-party financing requires you to pay a fixed monthly lease payment or per-kWh rate (PPA) for the solar energy produced by the system. According to the U.S. Department of Energy, this rate is 10% to 30% lower than your electric bills. As you are not the owner, the federal tax credit and other solar incentives' expiry will not impact your savings. Furthermore, with Prepaid Lease, you can even own a system with 30% off upfront in 6 years. However, it is vital to choose your solar leasing plans wisely. Solar SME, the top solar provider in New Mexico, offers the best solar lease options for making your solar journey affordable.

Best Residential Solar Incentives in New Mexico

You have access to some best solar incentives as a homeowner in New Mexico that can significantly increase the return on investing in solar panels. Solar panels can save you thousands of dollars, so the investment is well worth it. If you live in New Mexico, here are some ways to reduce the cost of solar installation:

01- Residential Clean Energy Credit

New Mexico homeowners who pay taxes can apply for the 30% federal tax credit when they switch to solar power. This tax credit is applied to federal income liability and is equal to 30% of the cost of installing a solar panel system. Remember that the tax credit is not an upfront payment. However, after December 31, 2025, this credit will expire. President Trump signed legislation on July 4, 2025, which completely cancels the home solar tax credit beginning on January 1, 2026, 10 years before it was supposed to expire.

02- Solar Market Development Tax Credit

The Solar Market Development Tax Credit (SMDTC) enables solar owners to receive a tax credit up to $6,000, which is equivalent to 10% of the labour, material, and equipment expenditures for a solar energy system. To qualify for this tax credit, solar energy installations must be approved by the New Mexico Energy, Minerals, and Natural Resources Department (EMNRD).

03- Sustainable Building Tax Credit (SBTC)

If you install solar in your home as part of your sustainable building efforts, you can receive a tax credit through the Sustainable Building Tax Credit (SBTC). Your home must be certified sustainable by the U.S. Green Building Council in order to be eligible; the credit’s worth is based on your certification level. It is not possible to claim the SBTC using solar panel systems that were used to claim the Solar Market Development Tax Credit (SMDTC).

04- New Mexico Solar Property Tax Exemption

In addition to the best rebates and incentives above, New Mexico now offers a tax exemption for solar panel systems. You won’t have to pay extra for the value your solar panels add to your property if you utilize solar energy as a source of power due to this solar property tax exemption.

Battery Storage Incentives in New Mexico

Installing a solar battery in New Mexico is a great way to boost your energy independence by giving you a free, clean source of backup power during outages. Currently, there are no state-specific battery incentives. However, any solar batteries bigger than 3 kWh are qualified for the 30% federal tax credit till December 31, 2025.

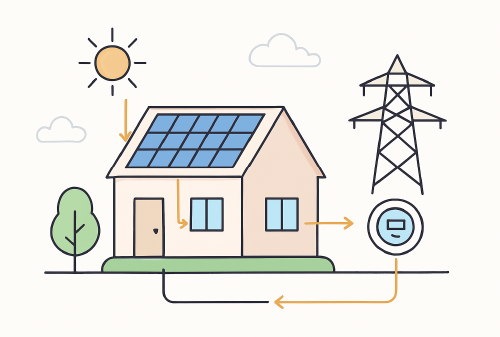

Is net metering available in New Mexico?

In New Mexico, net metering for solar panel systems under 10 kW must be supported by Investor Owned Utilities (IOUs) and regulated electric providers. Although net metering is not mandated by the state’s municipal utilities and electric cooperatives, many do it voluntarily, so be sure to verify with your particular supplier. For every kWh of electricity your system generates up to 100% of your utility electricity use, you will receive credits at the retail rate of electricity under New Mexico’s net metering program. Your credits are perpetually rolling over from month to month.

You will receive credit for your surplus generation at the avoided cost rate if you transmit more electricity to the grid than you consume. To find out your schedule, check with your particular utility company. Some offer an end-of-year payout, while others credit you at the end of each month. The utilities in New Mexico include Xcel Energy, PNM Resources, El Paso Electric Company, etc.

Commercial Solar Installation in New Mexico

Commercial solar installation in New Mexico is an effective way for businesses to combat all of the power challenges. Businesses can generate power using free and unlimited sunlight via commercial solar panels. Furthermore, using solar electricity combined with a reliable battery backup system like Tesla Powerwall 3 eliminates power disruptions. Hence, enabling smooth workflow and increased operational resiliency. Also, you are eligible for a 30% Investment Tax Credit for commercial solar systems. Additionally, High Performance Building Program, MACRS Depreciation, and PACE Financing options are available for business solar installation.

Why is it worth it to switch to solar in New Mexico?

Solar energy is an affordable and advantageous choice for homeowners and businesses in New Mexico due to the state’s abundant sunshine, the finest solar incentives, and municipal rebates. Utilizing sunshine as a power source can promote cleaner environmental practices, increase property value, and reduce energy costs.

Low Electric

Bills

Maximum Grid Independence

Flexible Financing Options

Increased Home Value

Earn Energy Credits/SREC Programs

The best way to determine how to maximize your solar savings in New Mexico is to consult with a local solar installer. Solar companies near you can guide you with the best solar solutions and incentives in your area and can help you to get the most out of your solar investment.

Calculate your Solar Savings with Solar SME Smart Solar Calculator NOW!

Step 1:

Property Type

Step 2:

Financing Options

Step 3:

Enter Your Current Electric

Bill & System Preferences

Our Customers are Getting Up to 90% Lower Electric Bills with

Solar SME Tailored

Solar Solutions

Solar SME provides its valuable clients with an exceptional solar experience by designing solutions according to its customers’ unique needs. Also, we hold a positive image in solar marketplaces like Energysage. Moreover, we are accredited with BBB, and our happy customers share their solar experience and highly recommend Solar SME for the best solar services in New Mexico.

City: Albuquerque, NM

System Size: 5 kW

Annual Savings: ~$900–$1,050 per year

City: Santa Fe, NM

System Size: 6.2 kW

Annual Savings: ~$1,050–$1,250 per year

City: Rio Rancho, NM

System Size: 7.5 kW

Annual Savings: ~$1,250–$1,450 per year

City: Las Cruces, NM

System Size: 8.8 kW

Annual Savings: ~$1,450–$1,700 per year

City: Roswell, NM

System Size: 10 kW

Annual Savings: ~$1,700–$1,950 per year

City: Farmington, NM

System Size: 11.5 kW

Annual Savings: ~$1,950–$2,250 per year

Frequently Asked Questions

Solar panels usually provide savings to offset your solar system expense in New Mexico within 13 years, and most residents will find that their estimated timeline is between 9 and 15 years. Your solar payback period will depend on many factors, including the size and price of your system, the amount of energy you use in an average month, the shading on your property and much more. You can use our solar calculator to get a more accurate estimate from a local solar installer.

The New Mexico New Solar Market Development Tax Credit (NSMDTC) offers tax credits against New Mexico state personal income tax for purchasing and installing solar systems on residences, businesses, and agricultural enterprises in New Mexico. The tax credit provides up to 10% of the purchase and installation costs of a solar thermal or photovoltaic system.

While there are New Mexico solar incentives for homeowners and businesses, truly free solar panels aren’t available. Some companies advertise free solar panels, but these usually involve solar lease or power purchase agreement (PPA) programs. With these, participants pay a monthly lease fee instead of upfront costs.

Yes, solar panels are likely worth it for homeowners and businesses in New Mexico. The state has abundant sunlight, so it is a favorable location for solar energy generation. Also, New Mexico solar incentives, such as net metering and solar property tax exemptions, make solar panels a cost-effective and environmentally friendly investment.