- Updated On: May 22, 2025

Solar Lease vs Buy:

Which Option is Best for Your Home?

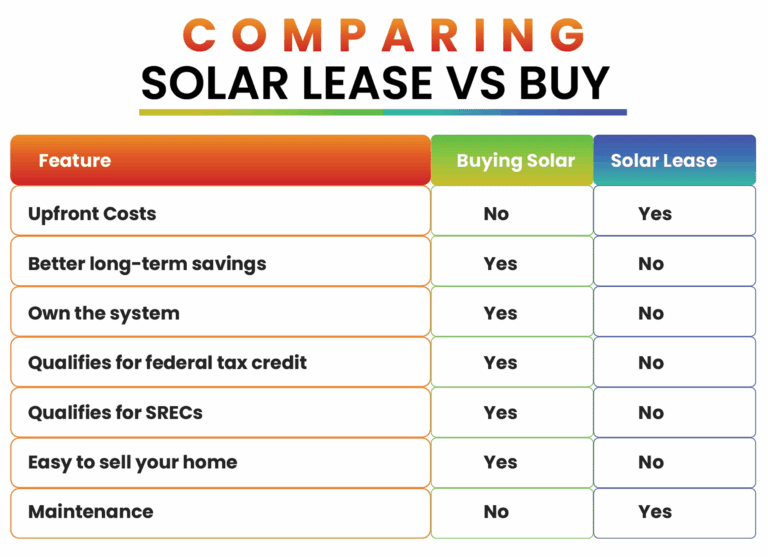

Booming inflation, rising utility rates, and frequent power outages in the U.S are the major reasons turning people toward smart solutions. Switching to solar power is a great opportunity for households and businesses to combat the high energy costs and reduce grid dependence. It may require an upfront cost to install solar panels, however, there are various solar financing options available to make solar accessible for everyone. If you have enough budget, buying a solar system is the best option of all. You can cut the upfront cost of solar by 30% federal tax credit and the other state solar incentives like net metering, buyback plans, or SREC programs. Between solar lease vs buy, you can choose solar leasing if you can’t manage to buy a home solar energy system. However, you will not qualify for the solar rebates and tax credits with a solar lease program.

It is important to decide which option is suitable for you according to your energy needs and budget. Let’s discuss solar lease vs buy and explore which option is more beneficial. Also, we will highlight when solar leasing is a good idea for you.

What is the difference between buying and leasing a solar panel system?

The major difference between solar leasing and purchasing is the ownership of the system. In solar leasing or a solar power purchase agreement (solar PPA), you pay no money initially to install solar panels on your rooftop. Instead, a solar company installs the solar system on your rooftop and owns it. However, you get the opportunity to use solar power to save your electricity bill and gain maximum grid independence. But you may not be able to acquire credits with net metering or qualify for SRECs using a leased solar system. Most of the time, these benefits come in the pocket of the solar leasing company. Additionally, you have to pay a monthly lease payment to the company for using solar power.

On the other hand, when you buy a solar panel system, either with cash or through a solar loan, it’s yours. You become qualified for all the state solar incentives and 30% tax credit. Also, you can send excess power to the grid and earn credits through net metering or solar buyback plans for a shorter payback period and more savings for future.

Comparing Solar Lease vs Buy

Savings in Long Run

If you are using solar power, no matter with a leased solar system or your rooftop solar, you will reduce your energy bills and become grid independent. But, if you buy a solar panel system, you will save more in the long run once your solar panels pay for themselves. As compared to solar leasing, your savings will be even greater if you buy a system with a solar loan. You do not need to pay any monthly payments like those who switch to a solar lease.

State Solar Incentives

If you choose the solar lease option, you will not be eligible for the state solar rebates and 30% federal tax credit. These benefits are for solar owners and help to cut the upfront solar installation cost. However, between solar lease vs buy, if you choose to own your system, the federal tax credit, solar renewable energy credits (SRECs), and various utility and state incentives are all available to you.

Monthly Charges

If you own a solar panel system, there are no monthly payments. However, if you have purchased it with a solar loan, you may need to pay a monthly installment for the loan duration. In contrast, solar leases come with a price escalation that shows how much the monthly leasing payments will increase annually. This implies that you will pay more in the third year of your lease than you did in the first. The escalator is determined by how much the price of electricity is predicted to increase in the future. On the other hand, you may end up paying more for your lease payment than you would have for an electricity bill without solar if power costs either grow very little or not at all in a year.

Increasing Property Value

Your home’s value rises when you own solar panels. According to surveys, homes with solar panels actually sell 20% faster and for 17% more money. However, leasing solar panels doesn’t add much value to your house and may make it much more difficult to sell to potential purchasers. Also, it is challenging to find a buyer who is willing to take over a 20 year agreement. Moreover, in case of a low credit score of the buyer, the company can refuse to extend the contract.

Solar Maintenance

When you buy solar panels, you are responsible for system maintenance and monitoring. You must identify any potential issues like PV system losses and pay for the solar repair. Fortunately, solar panels require very little upkeep but over the system’s lifetime, you should still budget for some maintenance and repairs, including changing the inverter. But if you have a solar lease, the solar leasing company will take care of the maintenance and repair issues.

What are the available solar loan options to buy solar panels?

Many financial institutions and solar providers provide loan options tailored to solar installation. Also, to encourage the use of solar energy, many states even provide loans with low or no interest. You can check the availability in your area by consulting with your certified solar installer, like Solar SME. However, the drawback of a solar loan is that you will pay a lot more in interest, which extends the solar payback period. The different types of loans include:

Personal Loan:

It has a high interest rate and often unfavorable terms, but it’s a quick and relatively easy option to get some cash.

Home Equity Loan:

With this, you can take out an upfront payment from the value of your house. Although the interest rate on this type of loan is lower, using your house as collateral for the loan can be risky.

Home Equity Line of Credit:

Another option to access your home equity is through a home equity line of credit, which functions more like a credit card than a one-time payment. However, keep in mind that these loans typically have variable interest rates, which may increase your payment over time.

When is leasing solar panels a good option for you?

While deciding between solar lease vs buy, it may seem attractive to install a solar energy system and utilize clean power without any big investment with solar leasing. But, if you compare the benefits of ownership, you may also agree that buying solar panels is the best option. You may consider a solar lease if:

- Not eligible for the federal tax credit

- Living in a state offering no local solar rebates, SRECs, or net metering programs

- You don’t have enough cash to buy solar and also not qualified for a solar loan

In conclusion, if you are choosing solar lease vs buy, purchasing is a more suitable option. Even between a solar lease and a loan, the better financing option is a solar loan. Regardless of whether it’s the best possible way to go about it, for many people who are looking to switch to solar, leasing panels is the only way. Solar SME, a trusted solar installer near you, offers affordable solar solutions with flexible financing options like 0% APR and solar loans. Book a FREE consultation with our energy expert for complete assistance. You can also Get a FREE Quote with our smart solar calculator.

Related Articles:

30% federal tax credit is expiring in 2025. But if you missed out on it, you can still access solar power with Solar Lease/PPA financing. This option is an opportunity to get all the advantages of solar power while making no large initial investments. Explore More!

Among the renewable energy sources, the most trending one is solar energy. But the question is, are solar panels worth it? Solar systems for homes are reliable systems.

Solar loans are a cost-effective solution for installing solar panels on your home or business. However, many are unsure about their functionality and the benefits they might derive from this type of solar financing.