This year, Five U.S. states are expected to introduce community solar programs. The trend of community solar will be challenging for Net Metering Schemes.

From 2018 to 2022, the US distributed solar market, which consists of projects with a capacity under 10 MW, doubled in size to 8 GW. Buildout was also delayed over the past four years by issues with trade policy, supply chain bottlenecks, and ongoing labor shortages But, on the other hand, they are boosted by record-breaking hikes in retail electric rates and rising consumer demand for clean energy.

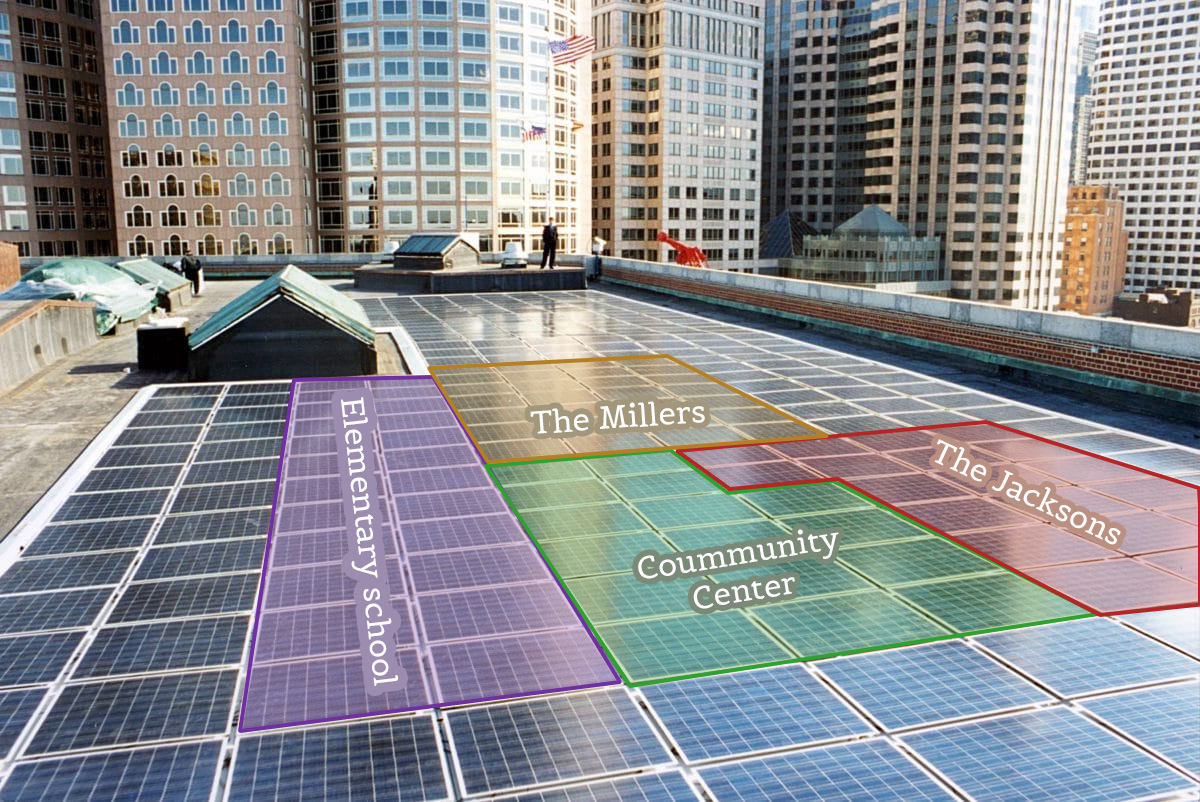

While community solar often involves signups for a share of generation from an off-site plant that provides commercial power to the grid, net metering involves crediting a customer bill for transferring excess solar generation to the grid.

Also, After a 10% increase in 2022, retail power costs in the US are predicted to rise again in 2023, reaching $0.154/kWh. This is an increase of 18.3% since 2019. According to experts, residential solar will have increased from 3.4% to 7% of the national market during the same time frame. Installers will have to come up with strategies to help their clients use more electricity on their own and rely less on net-metered energy as a result of the higher tariff rates. To maximize customer value, microgrid-forming devices, optimal system sizing, and energy storage are some of the available solutions.

In the current situation, Nation community solar programs are becoming more popular as net metering is phased out in several important markets. Under 13% of the market for distributed generation is made up of community solar, with little over 1 GW of additional capacity projected for 2022.

However, In in addition to several states with utility-run community solar initiatives, 13 states currently have formal community solar programs. Between 2022 and 2027, these schemes are expected to provide 7.3 GW of new solar power, according to Wood Mackenzie. The U.S Inflation Reduction Act‘s significant incentives and a federal push for community solar both contribute to this expansion.

Overall, Due to popularity of Community Solar Programs, Net metering continues to be affected. But with flexible financing options, the competitive edge might be achieved.